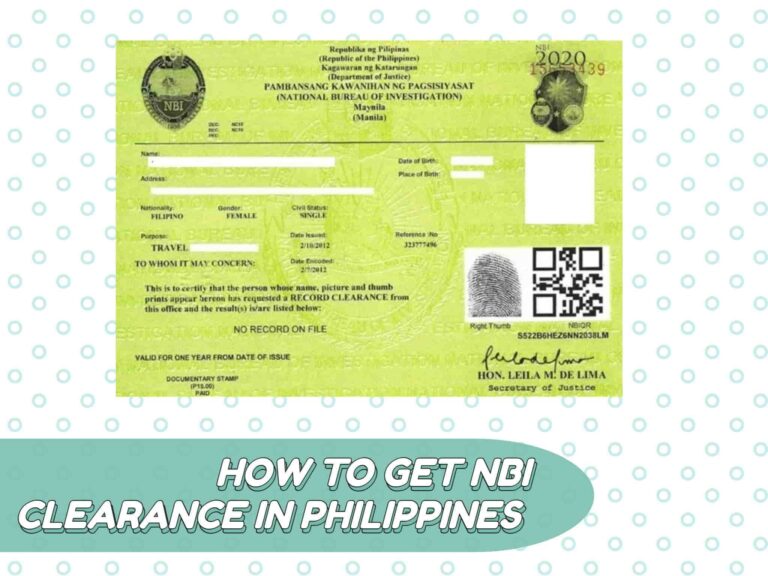

How to Get NBI Clearance Philippines Online

The clearance from the NBI may appear to be nothing more than a paper, but in reality, it reveals a great deal about your social position and image in the community. As a consequence of this, a great number of businesses and organizations consider this document to be a key need that is frequently non-negotiable….