Why is my GCash transfer not working?

Most people are using GCash to transfer money, since it honestly is the easiest way to send money all over the Philippines. You don’t even need to go to the bank, or deal with hefty online bank transfers just to send money to their families and loved ones.

However, you might sometimes deal with the issue where your GCash transfer is not working. There are currently several issues why this happens, and I will be helping you figure it out and resolve it!

How can I transfer money from GCash?

Before we go through the reasons why your GCash money transfer is not working, I will first give you an overview of how easily you can send money from your GCash wallet to another GCash account.

To send money from one GCash account to another GCash account, you can follow these steps:

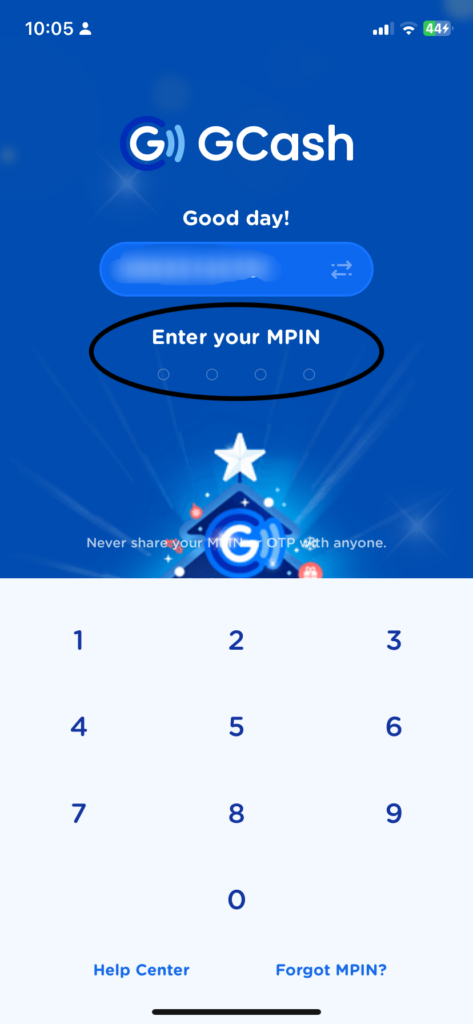

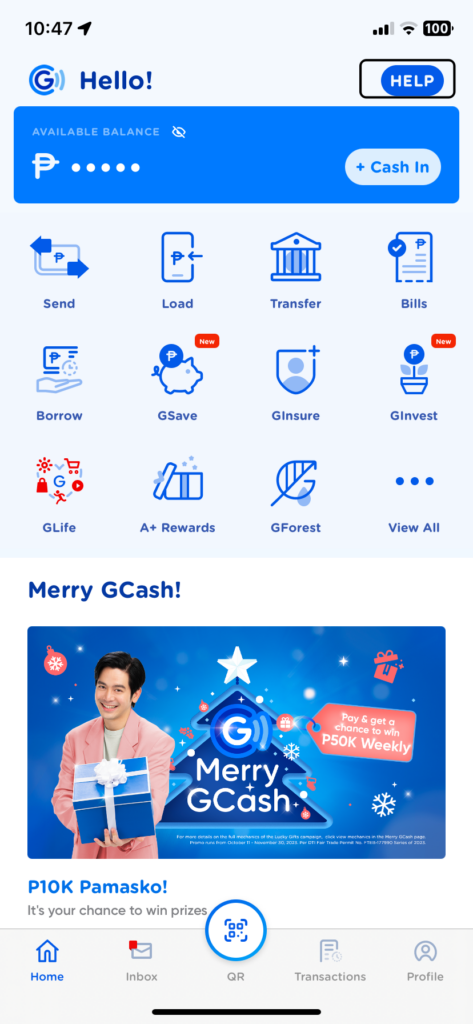

- Open the GCash app on your mobile device.

- Enter your 4-digit MPIN to log in to your account.

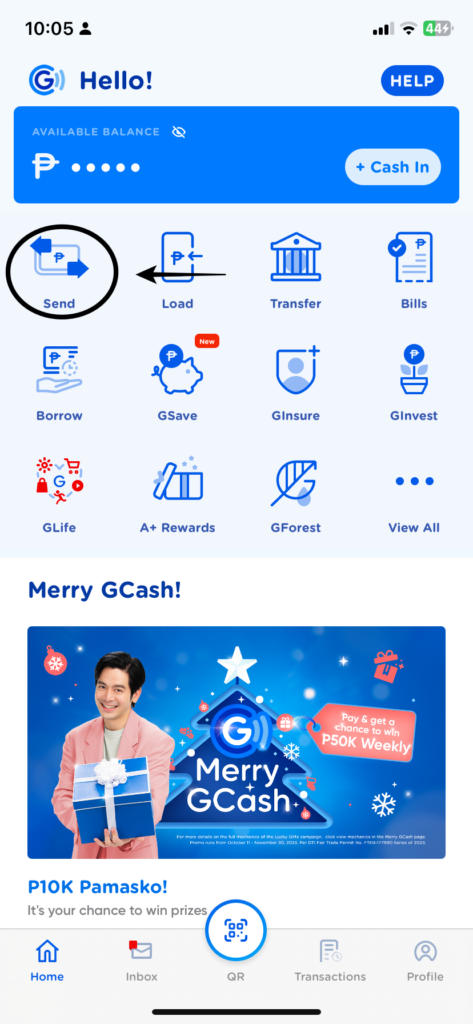

- On the home screen, select “Send Money”.

- Choose the “Send to GCash” option.

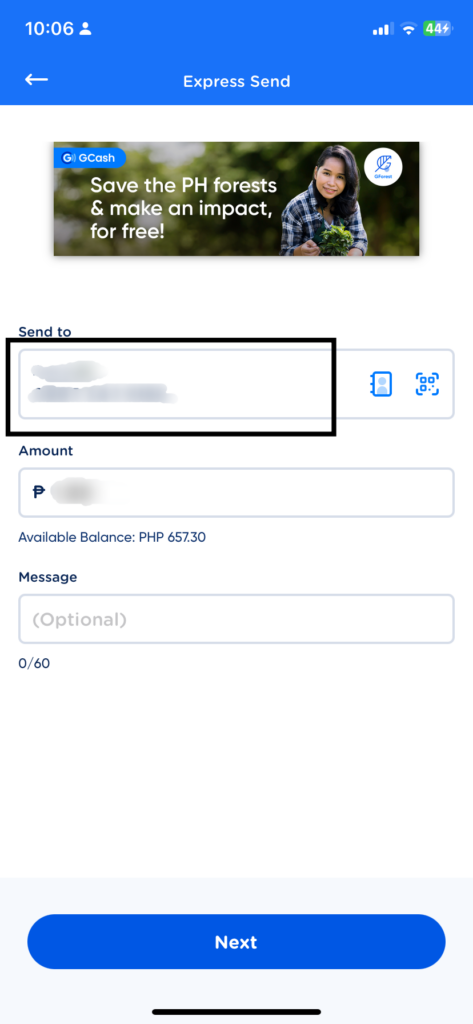

- Enter the mobile number of the recipient.

- Enter the amount you want to send.

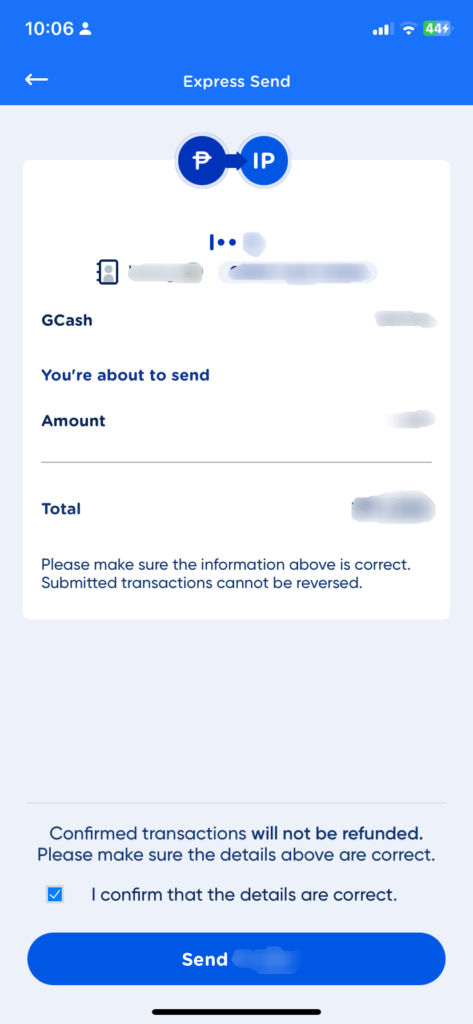

- Review the details of your transaction and confirm the amount.

- Enter a message for the recipient (optional).

- Tap “Send” to complete the transaction.

5 Reasons Why Your GCash Transfer is Not Working

There are several reasons why a GCash transfer may not be working. Here are some of the common issues and solutions:

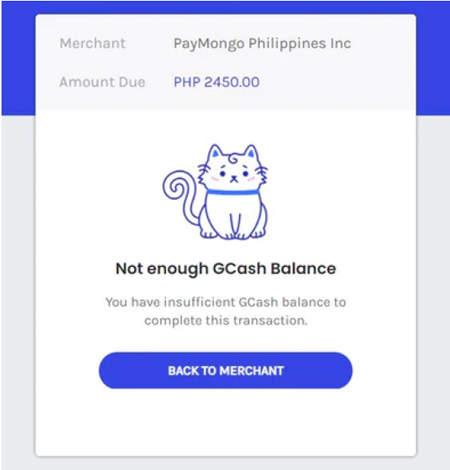

Insufficient Balance

Make sure that you have enough funds in your GCash account to cover the amount you want to transfer. As soon as you open the application and you have successfully logged in using your PIN, you would immediately see the available balance that you have on your wallet.

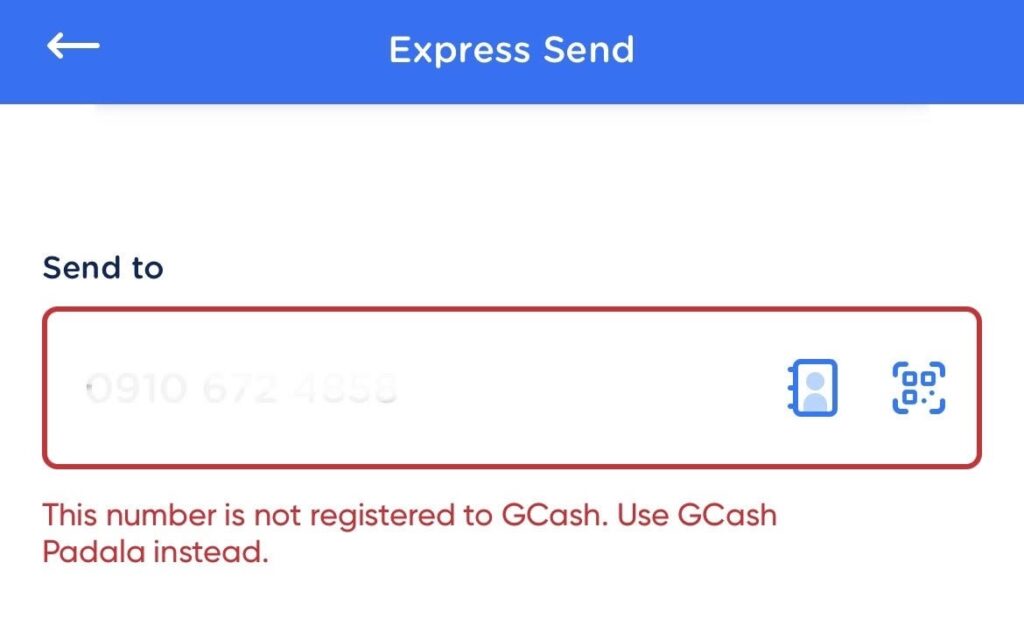

Incorrect Mobile Number

Double-check the mobile number of the recipient to make sure that it is correct. I also highly recommend that you contact the recipient as soon as you send the money since the transfer is usually real-time.

Network Issues

Check your internet connection as well as the recipient’s internet connection to make sure that there are no network issues that may be causing the problem. You have to remember that GCash works through WiFi or Mobile Data, so you need to ensure that you have a stable connection before sending your money.

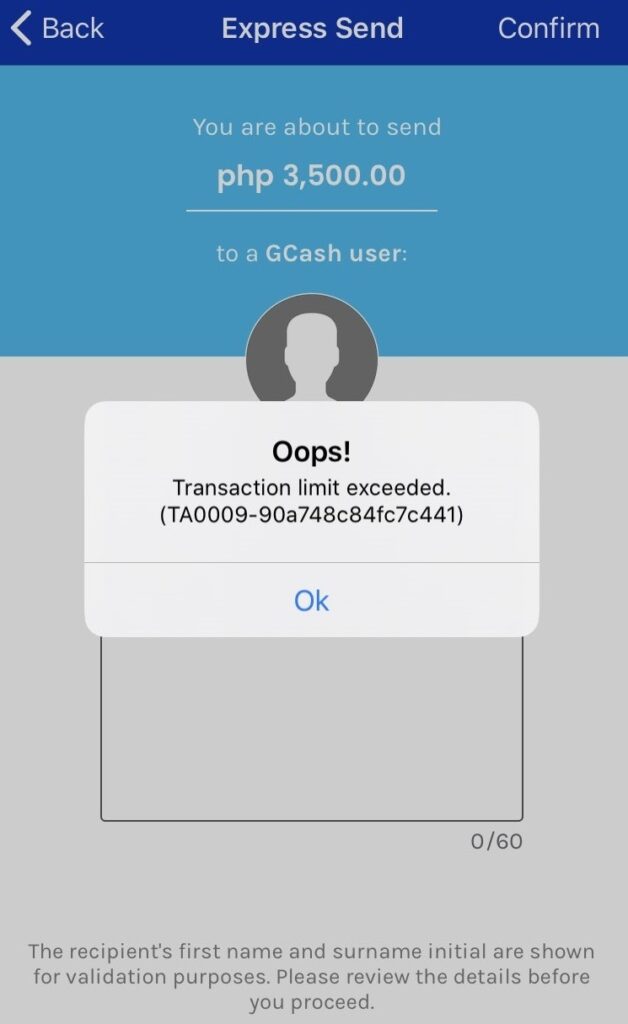

Transaction Limits

Check if you have reached your transaction limits for the month. If you have, you won’t be able to transfer any more funds until the next month. Read on to learn more about the transaction limits depending on your GCash verification.

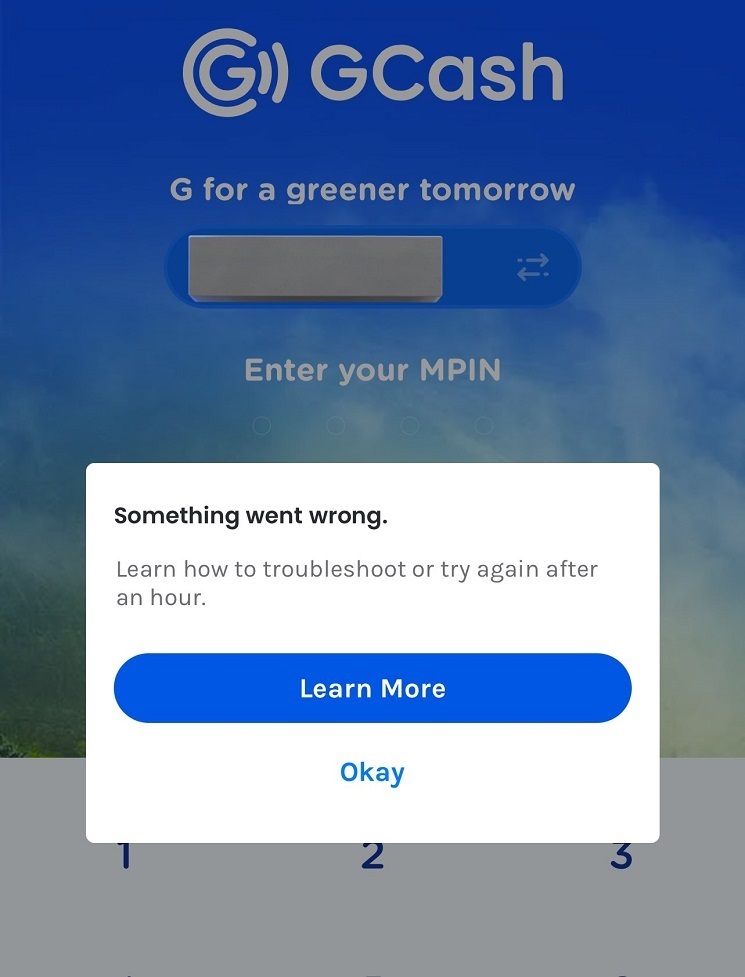

System Maintenance

GCash may be undergoing maintenance or upgrades, which can cause temporary disruption in the service. You would usually see an alert whenever there is on-going system maintenance for GCash. This also applies to paying bills and using the GCash Credit.

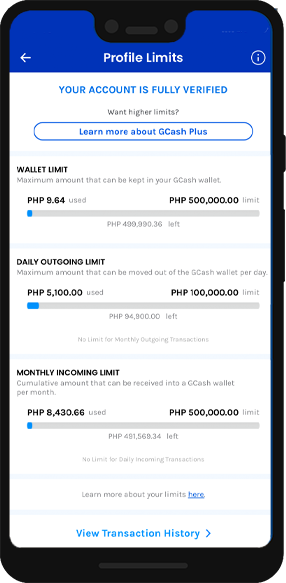

What is the sending limit on GCash?

The sending limit on GCash depends on the level of verification of your account.

Here are the different sending limits for GCash:

- Basic Level: If your GCash account is only verified with your mobile number, you can only send up to PHP 10,000 per month.

- Semi-Verified Level: If your GCash account is already verified with your personal information, you can send up to PHP 50,000 per month.

- Fully Verified Level: If you have completed the full verification process by submitting a valid ID, you can send up to PHP 500,000 per month.

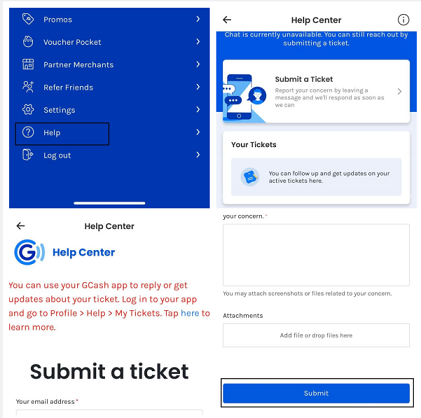

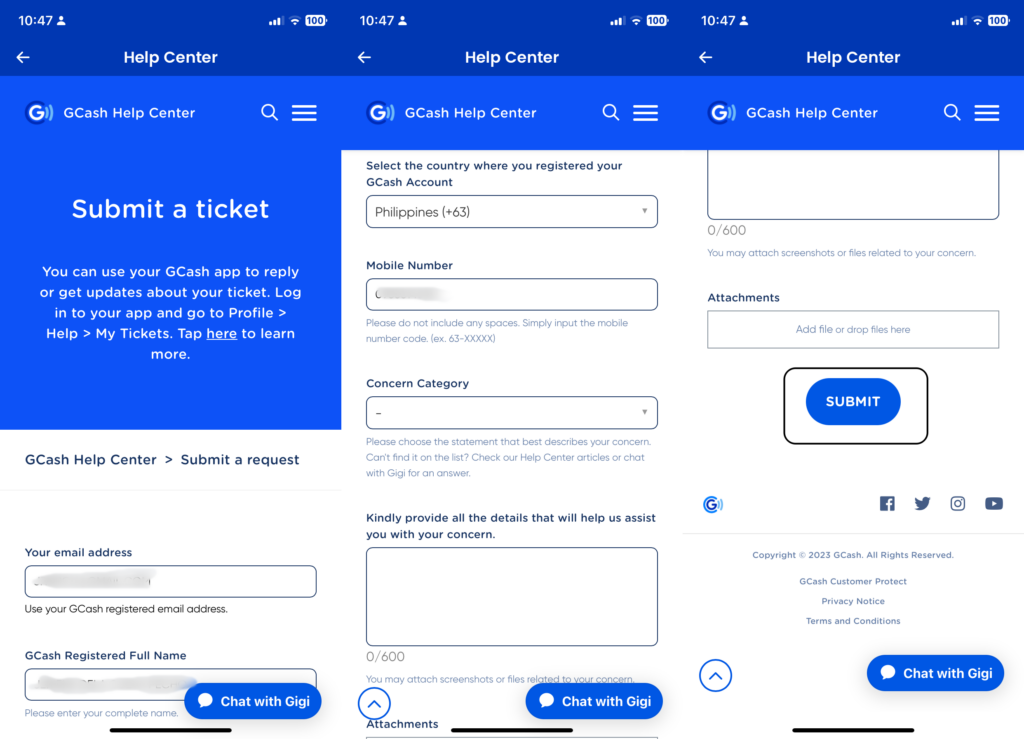

How do I report a failed GCash transaction?

If you encounter a failed GCash transaction, you can report it to GCash customer support by following these steps:

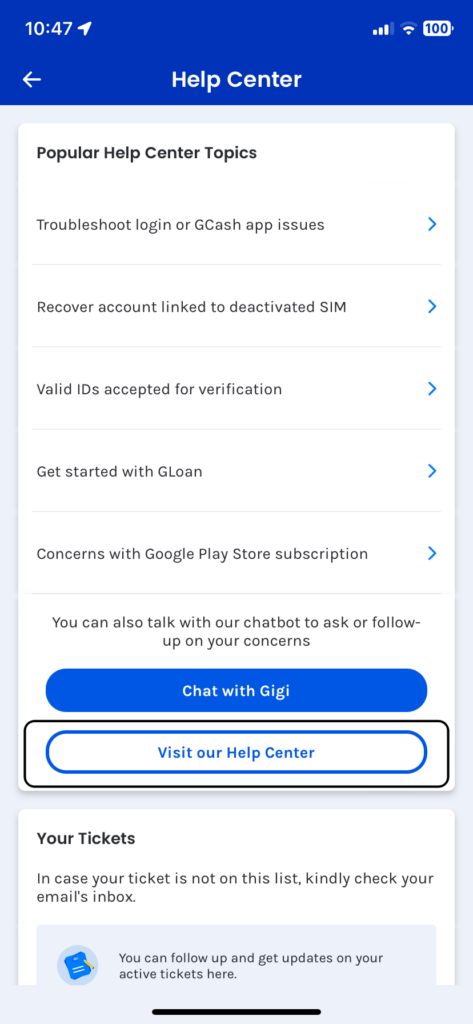

- Open the GCash app on your mobile device.

- Tap on “Help” on the main menu.

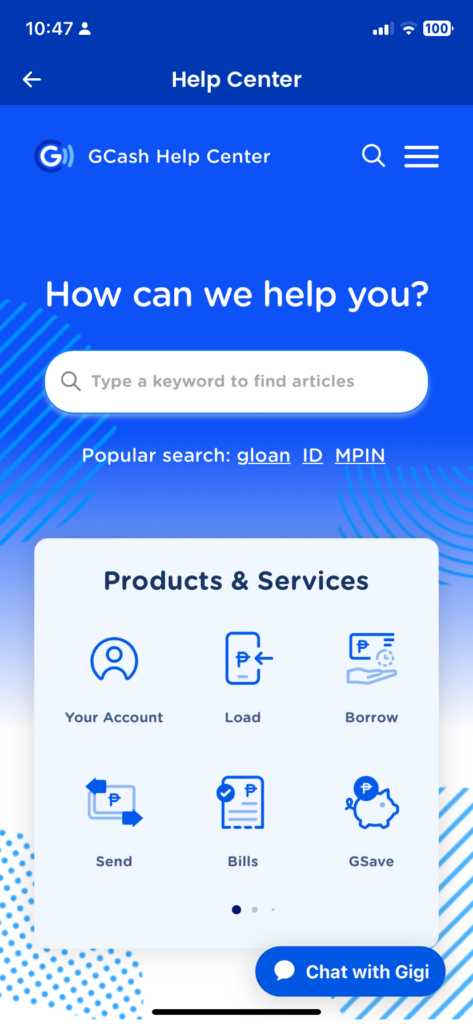

- Select “Help Center” from the list of options.

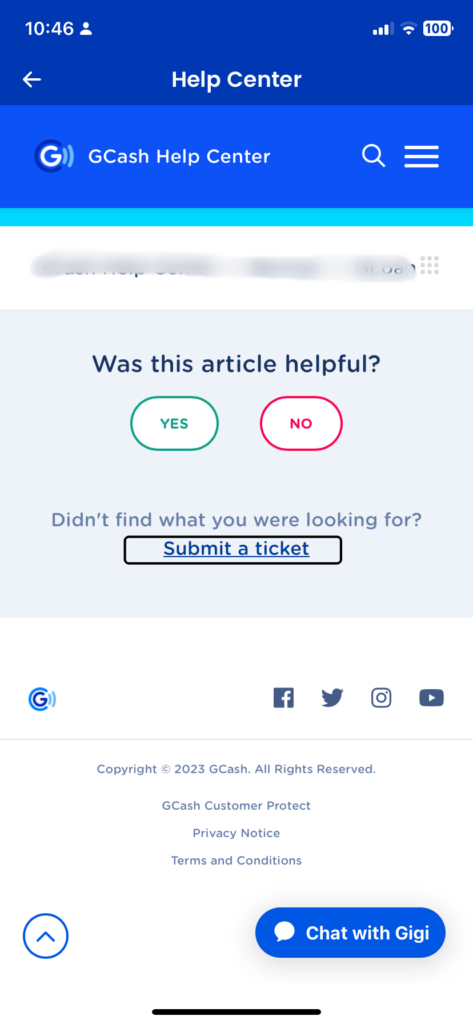

- Scroll down and click on “Submit a Request”.

- Click on Submit a Ticket

- Select the specific transaction that you want to report.

- Provide the necessary details of the failed transaction, including the date and time of the transaction, the recipient’s details, and the amount involved.

- Describe the issue you encountered and attach any relevant screenshots or documents.

- Click “Submit” to send your report.

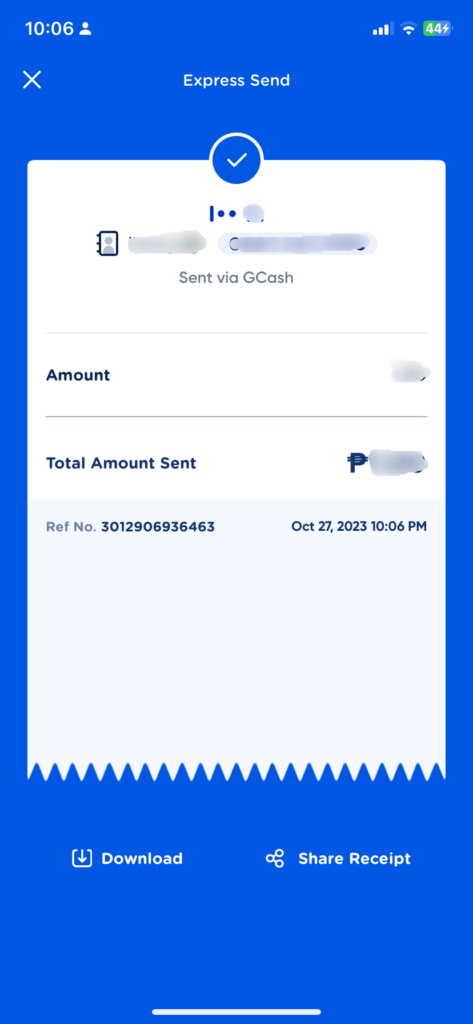

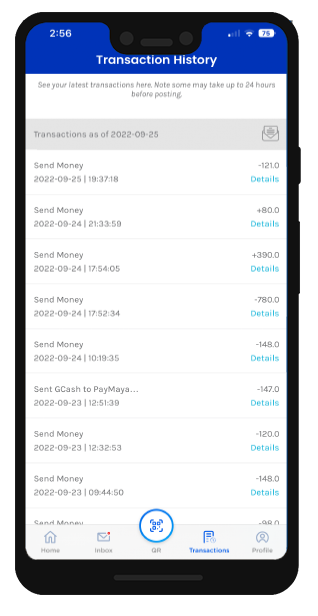

How do I know if my GCash transfer is successful?

After you initiate a GCash transfer, you can check the status of the transaction to confirm if it was successful. Here’s how:

- Open the GCash app on your mobile device.

- Log in to your account using your 4-digit MPIN.

- On the home screen, tap “Transaction History.”

- Look for the transaction you want to check and tap on it to view the details.

- Check the transaction status. If it says “Completed,” then the transfer was successful. If it says “Failed” or “Pending,” the transaction was not successful.

What to do if the money I sent was not received or I did not receive the money transferred to me?

The first thing that you can do is to check your network connection. If your connection is unstable, there are chances that you might not see the successful transfer if you don’t have a stable internet connection.

Next, you could also check if the money transfer has reflected on the sender’s account. If they confirm that the transfer activity is on their transaction history, then just wait for a while for the transfer to push through.

Lastly, if you never received any text message that the transfer was successful, you may initiate creating a ticket directly to the customer service. You may follow the steps that we have mentioned above.

Receive and Send Money to and from GCash Without Worries!

These reasons that we have mentioned above are the most important things to remember whenever you have issues with your transfer activities on GCash. Just make sure to follow the steps we have mentioned, but if all else fails – contact Customer Service right away! There would never be any harm in taking it to the GCash representatives after all.