Where Can I Cash In for GCash?

GCash, a widely used mobile wallet in the Philippines, has gained popularity for its convenience and versatility in managing financial transactions. One of the essential aspects of utilizing GCash is the ability to cash in or load funds into your GCash wallet. Cash-in options provide users with various ways to add money to their GCash account, allowing them to enjoy the full range of services offered by the platform. This article aims to explore the different cash-in methods available for GCash users, highlighting their features, benefits, and considerations.

GCash Cash-In Methods

GCash offers multiple cash-in options to cater to the diverse needs and preferences of its users. Let’s delve into each method to understand how it works and where you can access it.

Over-the-Counter (OTC) Partners

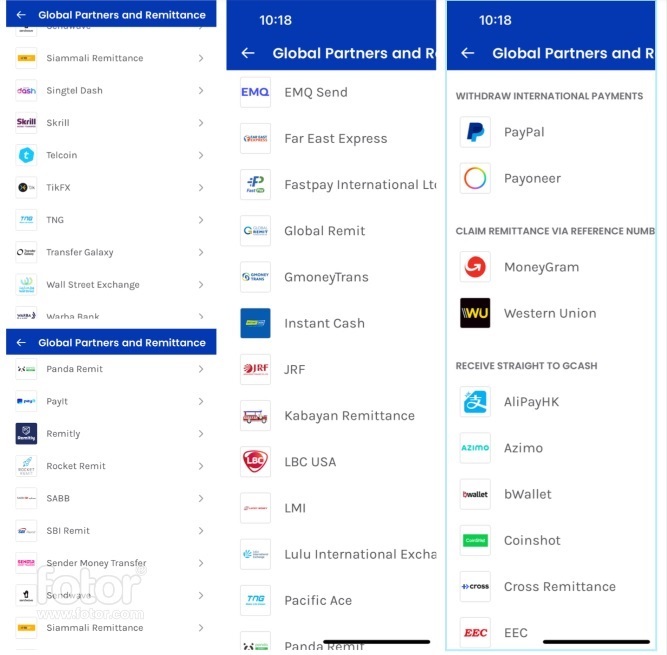

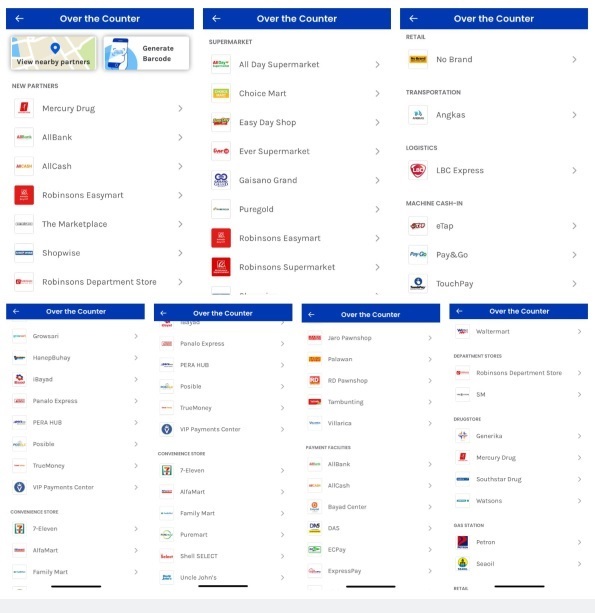

GCash has partnered with various establishments, including banks, remittance centers, and payment centers, to offer over-the-counter cash-in services. These partners are physical locations where users can visit and deposit money into their GCash wallets. Some popular OTC partners include:

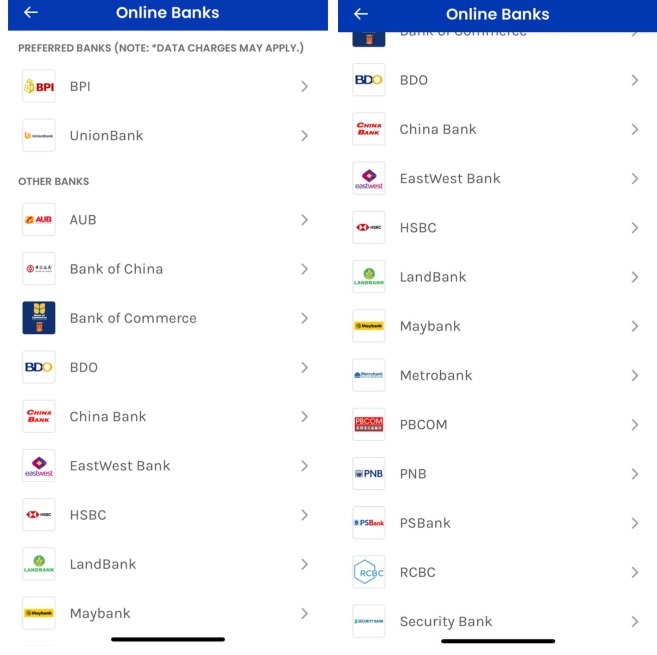

- Banks: Many banks in the Philippines have integrated with GCash to provide cash-in services. Users can visit partner banks such as BDO, UnionBank, RCBC, and more to deposit funds into their GCash accounts. Simply inform the teller that you want to cash into GCash and provide the necessary details.

- Remittance Centers: GCash has collaborated with remittance centers like Western Union and Palawan Pawnshop. Users can go to these centers, present their GCash mobile numbers, and provide the cash to be loaded into their GCash wallet. The transaction details will be processed, and the funds will be credited to the user’s GCash account.

- Payment Centers: Popular payment centers like 7-Eleven, Cebuana Lhuillier, and SM Business Services Centers offer GCash cash-in services. Users can approach the counter, inform the cashier that they want to cash into GCash, and provide the required information and funds for the transaction.

The OTC cash-in method provides a physical and convenient option for users who prefer face-to-face transactions and want immediate fund availability in their GCash accounts. It offers widespread accessibility, as these partner locations are present in various cities and towns across the Philippines.

Online Banking

GCash users can also cash in using their online banking accounts. By linking their bank accounts to their GCash wallets, users can transfer funds directly from their bank accounts to their GCash accounts through the GCash app or website. This method allows for quick and seamless transactions without the need to visit physical locations. Some banks that support GCash cash-in through online banking include BPI, Metrobank, and Security Bank.

To cash in using online banking, users need to navigate to the GCash cash-in section in their respective bank’s online banking platform, select GCash as the recipient, and enter the necessary details such as the GCash mobile number and the amount to be transferred. The transaction is processed, and the funds are reflected in the GCash wallet.

Mobile Banking

Like online banking, users can cash in for GCash through mobile banking applications. By linking their mobile banking accounts to GCash, users can initiate transfers from their mobile banking app directly to their GCash wallets. This method provides convenience, as users can perform cash-in transactions using their smartphones without the need for a separate GCash app.

GCash has established partnerships with several mobile banking services such as BPI Mobile Banking, UnionBank Online, and RCBC Mobile Banking. Users need to access their mobile banking app, select the GCash cash-in option, provide the required details, and authorize the transfer to complete the transaction.

GCash Mastercard

GCash users can also cash in by linking their GCash Mastercard to their GCash wallets. The GCash Mastercard functions as a prepaid card that can be used for cashless transactions. Users can load funds onto their GCash Mastercard through various methods, such as over-the-counter cash-in or online banking, and these funds will be reflected in their GCash wallet.

By utilizing the GCash Mastercard, users can shop online, make in-store purchases, and withdraw cash from ATMs that accept Mastercard. This method provides flexibility in accessing and using funds loaded into the GCash account.

GCash Partner Merchants

GCash has partnered with numerous merchants, including supermarkets, convenience stores, and retail outlets, where users can cash in or load funds into their GCash wallets. These partner merchants often have GCash kiosks or terminals where users can deposit cash directly into their GCash accounts. Some popular GCash partner merchants include Puregold, Robinsons Department Store, and SM Supermarkets.

Users can simply approach the GCash counter or kiosk at the partner merchant’s location, provide the cash, and provide the necessary information for the cash-in transaction. The funds will be credited to their GCash wallet, enabling them to use the balance for various transactions.

Considerations and Benefits:

When choosing a cash-in method for GCash, there are several factors to consider:

- Accessibility: Consider the availability and proximity of cash-in locations or partner merchants in your area. Opt for a method that offers convenience and is easily accessible based on your location.

- Transaction Limits: Different cash-in methods may have varying transaction limits. Check the maximum and minimum amounts allowed for each method to ensure it aligns with your cash-in requirements.

- Transaction Fees: Some cash-in methods may impose transaction fees or charges. Consider the associated fees and compare them across different methods to minimize costs.

- Processing Time: The processing time for cash-in transactions can vary. OTC cash-in methods typically provide immediate fund availability, while online transactions may take some time for the funds to reflect in your GCash wallet. Consider your urgency and time constraints when selecting a cash-in method.

Now that we have explored the various cash-in options for GCash, it’s important to highlight the benefits of utilizing these methods:

- Convenience: The availability of multiple cash-in methods provides users with flexibility and convenience in adding funds to their GCash wallets. Users can choose the method that aligns with their preferences and circumstances.

- Accessibility: The wide network of OTC partners, banks, payment centers, and mobile banking services makes it easy for users to find a cash-in location or method that suits their needs. This accessibility ensures that users can cash in regardless of their location.

- Seamless Integration: Cash-in options like online banking and mobile banking provide seamless integration between GCash and users’ existing banking accounts, making it convenient to transfer funds between accounts.

- Security: GCash utilizes encryption and security measures to ensure the safety of user transactions. By cashing in using authorized methods, users can have peace of mind knowing that their funds are protected.

Cashing in for GCash is an essential step in utilizing the mobile wallet’s features and services. GCash offers a range of cash-in methods, including over-the-counter partners, online banking, mobile banking, GCash Mastercard, and partner merchants. Each method has its own features, benefits, and considerations.

When choosing a cash-in method, consider factors such as accessibility, transaction limits, fees, and processing time. Evaluate your preferences and requirements to determine the most suitable cash-in option for your needs.

The availability of diverse cash-in options ensures that users can conveniently load funds into their GCash wallets, empowering them to make seamless transactions, pay bills, shop online, send money, and enjoy the benefits of a digital wallet that GCash offers.