Top Insurance Companies Philippines 2023

What is the best companies offering insurance in the Philippines?

This is an important question because many websites and blogs have different claims, so this article consolidates reports from the Insurance Commission released in July 2022.

2022 Insurance Commission report

We all know the importance of having a life insurance policy. It protects us from the cost of an untimely demise.

With the addition of insurance riders, it can expand coverage on accident, hospitalization, and critical illness that can provide us and our beneficiaries peace of mind.

And so the next question is who are among the best providers in the market. This year’s Insurance Commission‘s report covered the previous year, 2021. In the past, the government agency ranks each company in five categories:

- assets

- net income

- net worth

- paid up capital

- premium income

What’s new this year?

The Insurance Commission introduced a new metric: new business annual premium equivalent or NBAPE. According to IC Commissioner Dennis B. Funa in Business Mirror, it is used internationally to track the sales performance of the industry in a given year.

10 Best PH insurance companies

How did we come up with top ten ranking of insurance companies?

Data is consolidated by arranging the companies from highest to lowest separately according to the six metrics.

The company with the highest number in the category is ranked number 1, the next company becomes number 2, and so on. Bear in mind this is simply a shorthand way of bringing together these different metrics.

The result is a comparison as shown in the table.

And here are the top 10 life insurance companies.

| COMPANY | RANK |

|---|---|

| Sun Life of Canada (Philippines), Inc | 1 |

| Philippine Axa Life Insurance Corporation | 2 |

| Pru Life Insurance Corporation of U.K. | 3 |

| Allianz PNB Life Insurance Inc. | 4 |

| FWD Life Insurance Corporation | 5 |

| BDO Life Assurance Company Inc. | 6 |

| BPI-AIA Life Assurance Corporation | 7 |

| Manufacturers Life Insurance Co. (Phils.) Inc. | 8 |

| Manulife Chinabank Life Assurance Corporation | 9 |

| United Coconut Planters Life Assurance Corp | 10 |

Sun Life of Canada (Philippines) tops the list by being number 1 in two out of six categories. Sun Life of Canada follows next and Philippine AXA Life Insurance comes in third.

1. Sun Life of Canada (Philippines) Inc.

Sun Life of Canada (Philippines) Inc. comes first in the ranking of top insurance companies in the Philippines, coming in first in three key metrics.

The company was established in the country through the British company H.J. Andrews and Co. After halting its business during World War II, it resumed operation as soon as the war concluded. It offers a range of financial products including but not limited to insurance and mutual funds.

- Top #1 in premium income

- Top #1 in NBAPE

- Top #1 in net income

- Top #2 in assets

- Top #2 in net worth

- Top #17 in paid-up capital

1. Philippine American Life and General Insurance Company

Overall, it’s the Philippine American Life and General Insurance Company (life unit) or Philam Life that is the number 1 insurance company in the country as it is at least on the top 7 in each category.

A local subsidiary of American Insurance Association, Philam Life was established in 1947. It has expanded and now included subsidiaries such as the Philam Asset Management, Inc. (PAMI) and the BPI-Philam Life Assurance Corporation, a bancassurance outfit.

Philam has the following ranking:

- Top #1 in assets

- Top #1 in net worth

- Top #2 in net income

- Top #5 in paid up capital

- Top #6 in premium income

- Top #7 in NBAPE

3. Philippine AXA Life Insurance

Established in 1999, Philippine AXA Life Insurance speaks volumes on the company’s fast growth compared to other companies that had been operating for many years.

According to Investopedia, it is the number 1 insurance company in the world. In the country, it partners with Metrobank in serving its customers.

Philippine AXA is currently:

- Top #3 on premium income

- Top #3 in NBAPE

- Top #4 on net income

- Top #4 on assets

- Top #6 on net worth

- Top #7 on paid capital

4. Manufacturers Life Insurance Company (Philippines), Inc.

Manufacturers Life Insurance Company (Philippines), Inc. or Manulife comes in fourth on the list. The company sold its first policy in 1901 and was licensed to engage in the insurance business in the Philippines in 1907.

It has recently formed a partnership with China Banking Corporation, creating the subsidiary and bancassurance firm Manulife China Bank Life Assurance Corporation.

Manulife’s ranking is as follows:

- Top #4 in premium income

- Top #4 in NBAPE

- Top #4 in net worth

- Top #5 in assets

- Top #6 in net income

- Top #8 in paid-up capital

5. BDO Life Assurance Company, Inc (Generali Pilipinas Life)

BDO Life Assurance Company is number 4 in paid-up capital, number 7 in net worth, number 8 in premium income, number 9 in assets, and number 10 in net income. As a subsidiary of the BDO Unibank, it offers bancassurance solutions to its individual and corporate clientele.

BDO Life is:

- Top #4 in paid up capital

- Top #5 in net income

- Top #6 in NBAPE

- Top #7 in net income

- Top #7 in paid up capital

- Top #8 in asset

6. Insular Life Assurance Corporation

The Insular Life Assurance Company is ranked number 6 in the consolidated list across categories. It is number number 2 in net worth, number 3 in assets, number 5 in net income, number 7 in premium income, and number 30 in paid-up capital.

Established in 1910, the company has over a century-worth of history engaging in the insurance industry in the country. It was also considered at that time as the first Filipino life insurance company. In 1943, it acquired Filipinas Life Assurance Company and in 1955, its subsidiary in Hawaii was sold to the American General Insurance Group of Texas.

Insular Life is:

- Top #3 in asset

- Top #4 in net worth

- Top #5 in net income

- Top #8 in premium income

- Top #10 in NBAPE

- Top #10 in paid up capital

7. BPI Philam Life Assurance Corporation Inc.

The BPI Philam Life Assurance Corporation Inc. comes next in the ranking of top life insurance companies in the Philippines. It is currently ranked number 5 in assets and premium income, number 6 in net income, number 8 in net worth, and number 10 in paid-up capital. The company is a partnership between the Bank of the Philippine Islands and the Philippine American Life and General Insurance Company.

BPI Philam Life is:

- Top #5 in premium income

- Top #5 in NBAPE

- Top #6 in asset

- Top #7 in net worth

- Top #8 in net income

- Top #11 in paid up capital

8. Pru Life Insurance Corporation of U.K.

Coming in at number 8, Pru Life Insurance Corporation of U.K. is currently number 4 in premium income, number 7 in assets, number 7 in net income, number 9 in net worth, and number 4 in paid-up capital.

Established in 1996, the company was the first in the industry approved by the Insurance Commission to engage in dollar-denominated policies. In 2001, it acquired AllState Life Philippines and ING Life Philippines in 2002.

Pru Life is:

- Top #2 in premium income

- Top #2 in NBAPE

- Top #3 in net income

- Top #7 in asset

- Top #9 in net worth

- Top 20 in paid up capital

9. FWD Life Insurance Corporation

With international footprint in Hong Kong, Indonesia, Japan, Macau, Malaysia, Singapore, Thailand, and Vietnam, FWD Life Insurance Corporation established its operations in the country in September 2014. And yet it’s recorded fast growth despite its relatively brief history, now being part of the top 10 in three categories. It’s demonstrated strong performance in acquiring new business and premium income.

- Top #3 in paid up capital

- Top #8 in NBAPE

- Top #9 in premium income

- Top #11 in net worth

- Top #12 in net income

- Top #13 in asset

10. United Coconut Planters Life Assurance Corporation

The United Coconut Planters Life Assurance Corporation or COCOLIFE places number 5 in net worth, number 8 in net income, number 11 in premium income, number 12 in assets, and number 14 in paid-up capital.

Established about four decades ago, its subsidiaries include Cocolife Asset Management, Direct Link Car Insurance, Ultra Security Services Inc., and UCPB General Insurance Company. The company is known to the biggest Filipino-owned stock insurance company and the first Filipino insurance company to be ISO-certified.

Cocolife is:

- Top #8 in net worth

- Top #9 in NBAPE

- Top #10 in net income

- Top #11 in premium income

- Top #12 in asset

- Top #15 in paid up capital

Insurance company ranking based on asset

Asset is defined as a company owns, benefits from or has use of in generating income.

Philam ranks first on the list, making up a fifth of the entire industry in terms of asset. In fact, both Philam and Sun Life (which comes in second) combined represents over a third of the industry.

See below the chart, the best 10 companies on asset, and the Insurance Commission update.

| RANK | COMPANY | TOTAL |

|---|---|---|

| 1 | Philippine American Life & Gen. Ins. Co. (life unit ) | 290,159,607,279 |

| 2 | Sun Life of Canada (Philippines), Inc | 254,515,246,721 |

| 3 | Insular Life Assurance Company, Limited, The | 133,015,929,505 |

| 4 | Philippine Axa Life Insurance Corporation | 127,551,783,462 |

| 5 | Manufacturers Life Insurance Co.(Phils.), Inc., The | 114,899,552,272 |

| 6 | BPI-Philam Life Assurance Corporation | 108,825,947,777 |

| 7 | PRU Life Insurance Corporation of U.K | 106,222,905,282 |

| 8 | BDO Life Assurance Company, Inc. | 56,516,354,142 |

| 9 | Sun Life GREPA Financial, Inc. | 47,877,407,168 |

| 10 | Manulife Chinabank Life Assurance Corporation | 39,335,482,553 |

Insurance company ranking based on net worth

Net worth means the value of all the assets of the company after all liabilities have been deducted.

In 2020, Philam has the highest reported net worth, and by comparison it actually comprises over a third of the entire industry and is more than double in size to the company in second place, Sun Life of Canada (Philippines), Inc.

See the chart below.

Here’s the best 10 companies in terms of net worth in 2020.

| RANK | COMPANY | TOTAL |

|---|---|---|

| 1 | Philippine American Life & Gen. Ins. Co. (life unit ) | 87,684,334,099 |

| 2 | Sun Life of Canada (Philippines), Inc | 38,002,386,250 |

| 3 | Insular Life Assurance Company, Limited, The | 33,572,950,760 |

| 4 | Manufacturers Life Insurance Co.(Phils.), Inc., The | 16,141,908,184 |

| 5 | BDO Life Assurance Company, Inc. | 9,007,078,835 |

| 6 | Philippine Axa Life Insurance Corporation | 8,285,050,497 |

| 7 | BPI-Philam Life Assurance Corporation | 7,940,134,280 |

| 8 | United Coconut Planters Life Assurance Corp | 4,970,389,867 |

| 9 | PRU Life Insurance Corporation of U.K | 4,642,466,688 |

| 10 | Sun Life GREPA Financial, Inc. | 4,573,781,673 |

And here is the complete Insurance Commission net worth report.

Insurance company ranking based on NBAPE

NBAPE is new business annual premium equivalent, which is a new metric that is introduced this year by the Insurance Commission. It is derived from all the premiums paid or the annualized value of the first premium payment for newly opened insurance plans, plus 10% of single premiums.

Sun Life is ranked number 1, followed by PRU Life, Philippine AXA, Manulife and BPI-Philam.

| RANK | COMPANY | TOTAL |

|---|---|---|

| 1 | Sun Life of Canada (Philippines), Inc | 9,613,968,994 |

| 2 | PRU Life Insurance Corporation of U.K | 7,670,306,621 |

| 3 | Philippine Axa Life Insurance Corporation | 5,497,228,940 |

| 4 | Manufacturers Life Insurance Co.(Phils.), Inc., The | 4,358,045,029 |

| 5 | BPI-Philam Life Assurance Corporation | 3,903,271,770 |

| 6 | BDO Life Assurance Company, Inc. | 3,676,916,026 |

| 7 | Philippine American Life & Gen. Ins. Co. (life unit ) | 3,475,138,508 |

| 8 | FWD Life Insurance Corporation | 2,936,592,061 |

| 9 | United Coconut Planters Life Assurance Corp | 2,175,946,553 |

| 10 | Insular Life Assurance Company, Limited, The | 1,913,216,661 |

The report also breaks down the numbers into traditional insurance products (such as term insurance plans) and variable universal life plans.

Under the traditional category, the market leaders are BDO Life Assurance Company, Inc., United Coconut Planters Life Assurance Corp, Sun Life of Canada (Philippines), Inc, Manulife, and Pioneer Life.

These five companies sold nearly half of all traditional insurance products (45.32%) as new business in 2020.

On the other hand, Sun Life of Canada (Philippines), Inc, PRU Life Insurance Corporation of U.K and Philippine Axa Life Insurance Corporation lead the pack on selling VUL plans.

These three companies alone sold over half of VUL products as new business (53.94%) in the country.

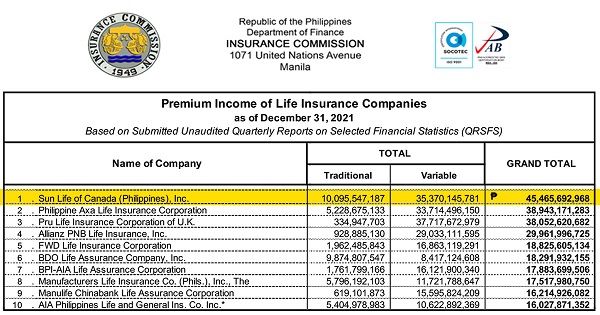

Insurance company ranking based on premium income

Premium income means the total amount of collections that were paid for all policies by the policyholders.

The table below shows the total of both traditional and variable universal life (VUL) insurance policies, whether single-pay or regular-pay contracts.

Sun Life is #1 on this category, and it is followed by PRU Life, Philippine AXA, Manulife, and BPI-Philam. These five companies already earned over half of the premium income (54.85%) collected in all of the insurance industry.

| RANK | COMPANY | TOTAL |

|---|---|---|

| 1 | Sun Life of Canada (Philippines), Inc | 39,513,806,284 |

| 2 | PRU Life Insurance Corporation of U.K | 26,965,125,719 |

| 3 | Philippine Axa Life Insurance Corporation | 26,236,763,146 |

| 4 | Manufacturers Life Insurance Co.(Phils.), Inc., The | 18,346,405,023 |

| 5 | BPI-Philam Life Assurance Corporation | 17,236,004,380 |

| 6 | Philippine American Life & Gen. Ins. Co. (life unit ) | 16,636,434,473 |

| 7 | BDO Life Assurance Company, Inc. | 14,875,396,349 |

| 8 | Insular Life Assurance Company, Limited, The | 12,674,304,438 |

| 9 | FWD Life Insurance Corporation | 9,521,266,364 |

| 10 | Allianz PNB Life Insurance, Inc. | 9,444,335,690 |

Insurance company ranking based on net income

Net income is the total earnings of the company minus all expenses and taxes. For this category, Sun Life is ranked #1. Philam, Pru Life, Philippine AXA and Insular Life complete the top 5.

| RANK | COMPANY | TOTAL |

|---|---|---|

| 1 | Sun Life of Canada (Philippines), Inc | 8,210,981,224 |

| 2 | Philippine American Life & Gen. Ins. Co. (life unit ) | 7,665,044,618 |

| 3 | PRU Life Insurance Corporation of U.K | 4,395,140,002 |

| 4 | Philippine Axa Life Insurance Corporation | 3,388,641,553 |

| 5 | Insular Life Assurance Company, Limited, The | 2,940,203,812 |

| 6 | Manufacturers Life Insurance Co.(Phils.), Inc., The | 2,787,913,240 |

| 7 | BDO Life Assurance Company, Inc. | 2,225,365,775 |

| 8 | BPI-Philam Life Assurance Corporation | 1,175,442,370 |

| 9 | Sun Life GREPA Financial, Inc. | 845,855,710 |

| 10 | United Coconut Planters Life Assurance Corp | 719,536,317 |

Insurance company ranking based on paid up capital

Paid-up capital represents the actual contribution of all shareholders in the company had given in exchange for stocks. East West Aegas Life Insurance Corporation is ranked first, and it is followed by Generali Life, FWD Life, BDO Life and Philam.

| RANK | COMPANY | TOTAL |

|---|---|---|

| 1 | East West Aegas Life Insurance Corporation | 2,396,670,000 |

| 2 | Generali Life Assurance Philippines, Inc | 2,321,260,600 |

| 3 | FWD Life Insurance Corporation | 2,300,000,000 |

| 4 | BDO Life Assurance Company, Inc. | 1,593,132,400 |

| 5 | Philippine American Life & Gen. Ins. Co. (life unit ) | 1,500,000,000 |

| 6 | 1 CISP Life and General Insurance (life unit) | 1,084,691,875 |

| 7 | Philippine Axa Life Insurance Corporation | 1,000,000,000 |

| 8 | Manufacturers Life Insurance Co.(Phils.), Inc., The | 930,000,000 |

| 9 | CLIMBS Life & General Insurance Coop. (life unit) | 917,943,597 |

| 10 | Insular Life Assurance Company, Limited, The | 900,000,000 |

Read More:

Choosing Right People Can Become Beneficiary Life Insurance

Important Things Need Know Insurance

Faq Frequently Asked Questions Every Pinoy Must Know Life Insurance Philippines