Is PayMaya Better than GCash?

PayMaya and GCash are two prominent digital financial services providers in the Philippines, offering similar features such as mobile wallets, online payments, remittances, and cashless transactions. Both platforms have gained popularity and transformed the way Filipinos manage their finances. This article will compare PayMaya and GCash across various factors to determine which one might be considered better.

Accessibility and User Base

Both PayMaya and GCash have a wide user base and offer accessible services. PayMaya requires users to download the PayMaya app and register for an account, while GCash can be accessed through the GCash app or *143# on mobile phones. PayMaya has also expanded its services to physical prepaid cards, allowing users without smartphones to access their funds. In terms of availability, GCash may have a slight advantage as it is supported by Globe Telecom, one of the largest telecommunications providers in the Philippines, giving it a broader reach and recognition.

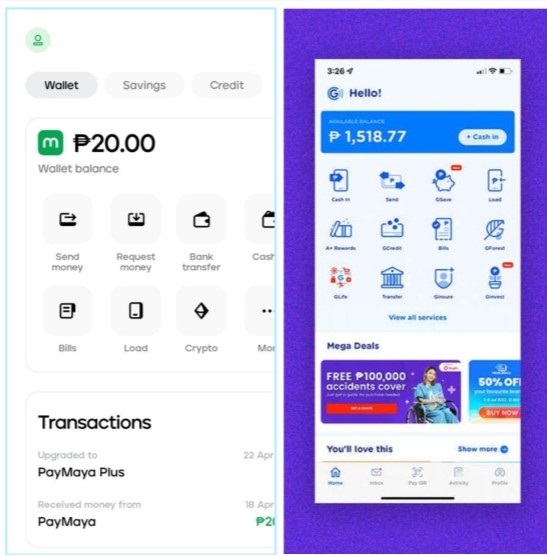

Features and Functionality

Both PayMaya and GCash offer a range of features, including the ability to load money, pay bills, transfer funds, purchase goods and services, and withdraw cash.

However, there are differences in terms of additional functionalities. PayMaya stands out with its virtual Visa card feature, which allows users to make online purchases from international merchants that accept Visa payments.

This can be particularly useful for individuals who frequently engage in cross-border transactions. GCash, on the other hand, offers a wider network of partner merchants and establishments where users can transact using their GCash accounts. GCash also offers a savings account option called GSave, which allows users to earn interest on their savings.

The availability of unique features and functionality might influence users’ preferences depending on their specific needs.

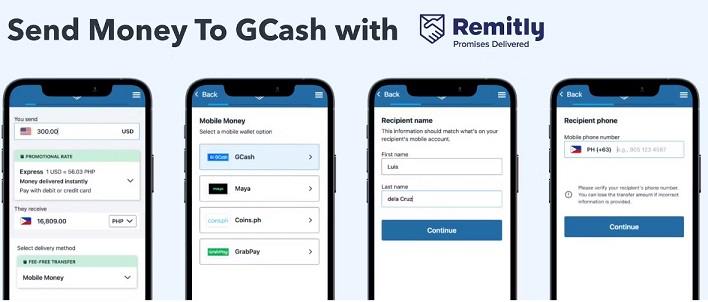

Remittance and International Transfer

Both PayMaya and GCash have partnered with remittance companies to facilitate international transfers. PayMaya has partnerships with Western Union and MoneyGram, allowing users to receive remittances directly into their PayMaya account.

GCash, on the other hand, has collaborations with MoneyGram, AlipayHK, and WorldRemit, providing users with various options for international money transfers. While the availability of remittance partners may vary, both platforms offer convenience and accessibility for receiving money from abroad.

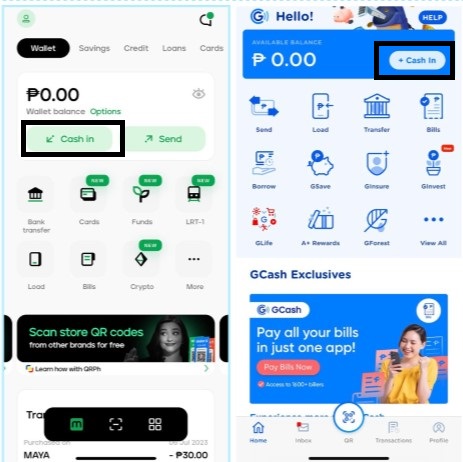

Cash-In and Cash-Out Options

PayMaya and GCash offer multiple channels for cashing in and cashing out. Both platforms allow users to load funds through various methods, such as bank transfers, over-the-counter transactions, and remittance centers. PayMaya users can also load their accounts through 7-Eleven stores and select partner establishments, while GCash users can use Globe and TM mobile phone load.

Regarding cashing out, both platforms provide options for withdrawing funds at partner outlets, ATMs, or bank transfers. The availability of cash-in and cash-out options may vary depending on the user’s location and the partnerships established by each platform.

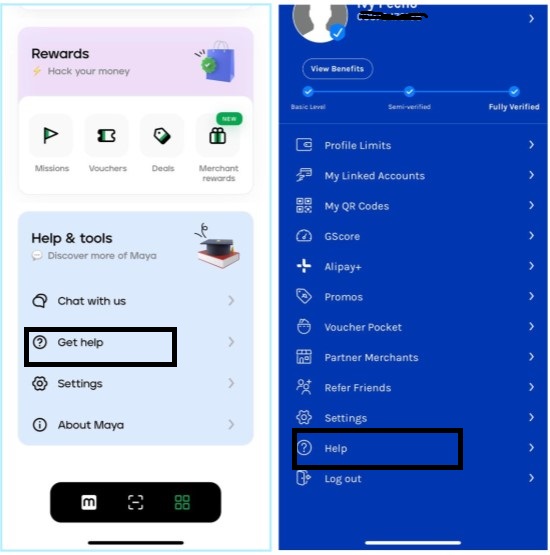

Security and Customer Support

Security is a crucial aspect when it comes to digital financial services. PayMaya and GCash have implemented security measures to protect user information and transactions. Both platforms utilize encryption technologies to secure data and offer two-factor authentication for added account protection.

Additionally, PayMaya and GCash have customer support channels, including hotlines and online help centers, to assist users with any concerns or issues they may encounter.

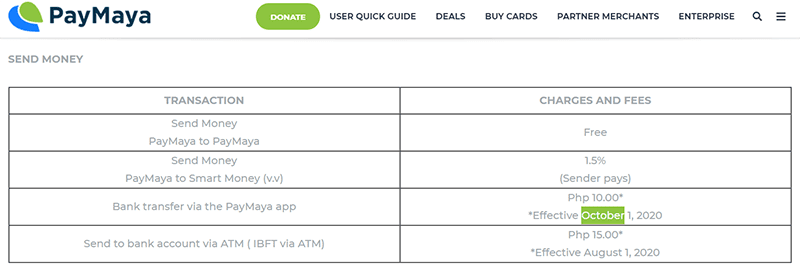

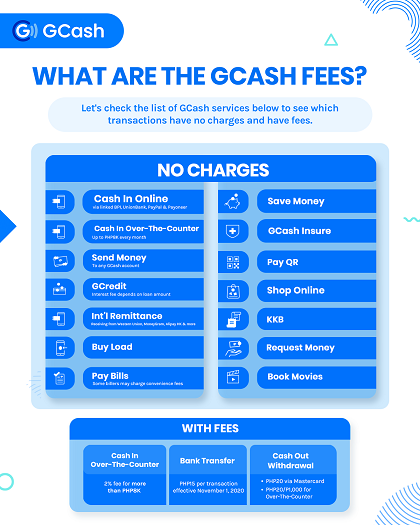

Fees and Charges

Fees and charges are important for users when comparing digital financial services. Both PayMaya and GCash have fee structures that include charges for specific transactions, such as cashing in, cashing out, and fund transfers. It’s important for users to review and compare the fee schedules of both platforms to determine which one aligns better with their transaction patterns and financial needs.

Ecosystem and Partnerships

PayMaya and GCash have partnered with various retailers and outlets, expanding their ecosystem and providing users with a seamless transaction.

PayMaya has partnered with a variety of retailers including online shopping platforms, transportation services and retail outlets, while GCash has a broader network of partner retailers and outlets in the areas of dining, shopping, entertainment and bill payment. The availability of partner merchants and the integration of platforms into daily transactions can greatly enhance the user experience.

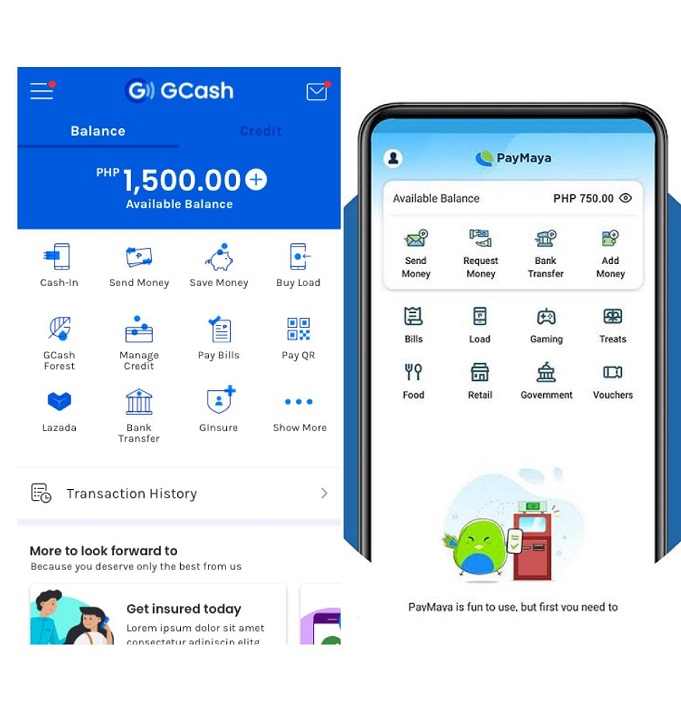

User Interface and User Experience

The user interface and experience play a significant role in determining which platform is better for users. Both PayMaya and GCash have user-friendly interfaces, making it easy for users to navigate through the app and perform transactions.

However, some users may have a personal preference for the layout, design, and overall user experience of one platform over the other. It is recommended to try out the apps and see which one feels more intuitive and comfortable to use.

Promotions and Rewards

PayMaya and GCash often run promotions, discounts, and cashback offers to incentivize users and encourage transactions. These promotions can vary in terms of the partner merchants, exclusive deals, and rewards offered. Users should compare the ongoing promotions and rewards programs of both platforms to determine which one aligns better with their spending habits and preferences.

Additional Features and Innovations In the Future

PayMaya and GCash are continuously evolving to meet the changing needs of users and the digital financial landscape. It’s advisable to stay informed about their future plans, product enhancements, and partnerships. Both platforms may introduce new features or services that could significantly impact their overall value and appeal.

PayMaya vs. GCash: Which Should I Choose?

The choice between PayMaya and GCash ultimately depends on individual preferences and needs. PayMaya may be more advantageous for individuals who frequently engage in cross-border transactions due to its virtual Visa card feature and international remittance partnerships.

On the other hand, GCash offers a broader network of partner merchants and establishments, along with additional features like GSave for savings. It is advisable for users to evaluate their specific requirements, consider the features, fees, accessibility, and functionality of both platforms and choose the one that aligns best with their financial goals and transaction patterns.

It is recommended to consider factors such as accessibility, features, remittance options, fees, security, user experience, promotions, integration, transaction limits, network reliability, and future developments to make an informed decision. Evaluating these aspects will help you determine which platform suits your requirements and provides a better overall digital financial experience.

Have a great time transacting with any of these two amazing platforms!