Can PayMaya Be Converted to Cash?

PayMaya is a popular digital financial services provider in the Philippines that offers convenient and secure cashless transactions. While PayMaya is primarily designed for digital payments, there are instances when users may need to convert their PayMaya balance into physical cash. In this article, we will explore the various withdrawal options available to PayMaya users, providing insights into how you can convert your PayMaya funds into cash when needed.

Option 1: Withdrawal via PayMaya Physical Card

One of the most straightforward ways to convert your PayMaya balance into cash is through a PayMaya physical card. If you have a physical card linked to your PayMaya account, you can withdraw cash at any BancNet or Visa Plus ATM in the Philippines or any ATMs abroad that accept Visa or Mastercard. Simply insert your card, follow the instructions on the ATM screen, and choose the “Withdraw” option. You can then enter the desired amount to be withdrawn, and the cash will be dispensed from the ATM. It is important to note that some ATMs may charge a withdrawal fee, so it’s advisable to check the terms and conditions of the specific ATM before proceeding with the transaction.

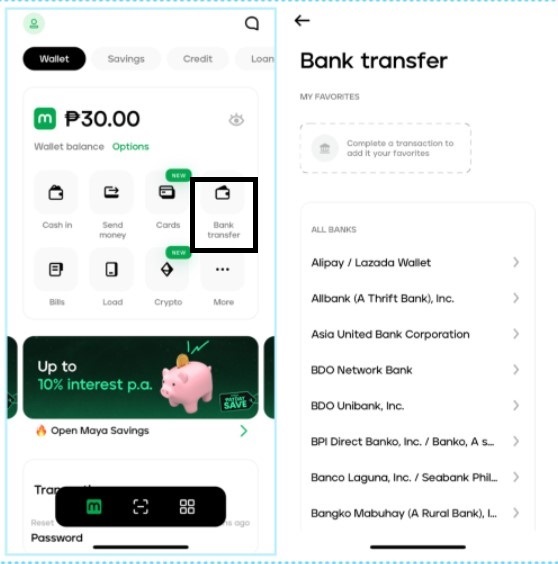

Option 2: Transfer to a Bank Account

Another option to convert your PayMaya funds into cash is by transferring the balance to your linked bank account. PayMaya allows users to link their PayMaya account to their preferred bank account. To initiate a transfer, open the PayMaya app and go to the “Bank Transfer” option. Select the linked bank account, enter the amount you wish to transfer and confirm the transaction. The funds will be transferred to your bank account, and you can then withdraw the cash from an ATM or conduct over-the-counter withdrawals at your bank branch. It is important to note that some banks may impose transfer fees or have specific withdrawal requirements, so it’s recommended to check with your bank for any applicable charges or procedures.

Option 3: Cash-Out at Partner Establishments

PayMaya has a wide network of partner establishments that offer cash-out services, allowing you to convert your PayMaya balance into physical cash. These establishments include pawnshops, remittance centers, and authorized PayMaya partner outlets. To avail of this service, visit a participating establishment and inform the cashier that you would like to cash out your PayMaya funds. Provide your PayMaya mobile number and the desired withdrawal amount. The cashier will process the transaction, and you will receive the cash equivalent of your PayMaya balance. It is important to note that some establishments may charge a cash-out fee, so it’s advisable to inquire about any applicable fees beforehand.

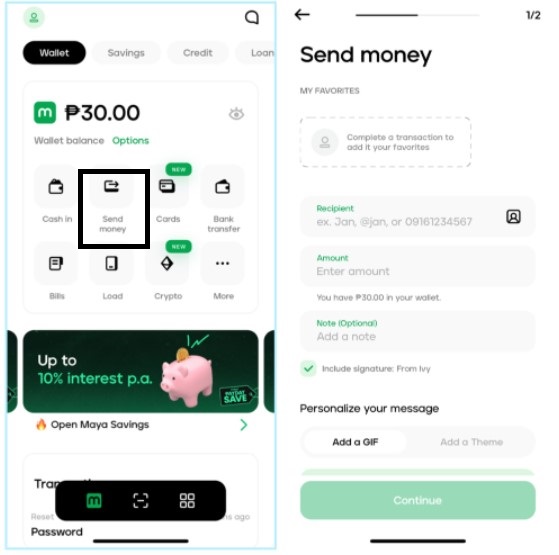

Option 4: Peer-to-Peer Cash Transfer

If you have family or friends who also use PayMaya, you can opt for a peer-to-peer cash transfer to convert your PayMaya funds into physical cash. Using the PayMaya app, select the “Send Money” option and enter the mobile number or email address of the recipient. Choose the amount to transfer, and once the transaction is complete, inform the recipient to withdraw the cash from their PayMaya account. They can then provide you with the equivalent amount in physical cash. This method eliminates the need for withdrawal fees or charges, making it a convenient way to convert PayMaya funds into cash.

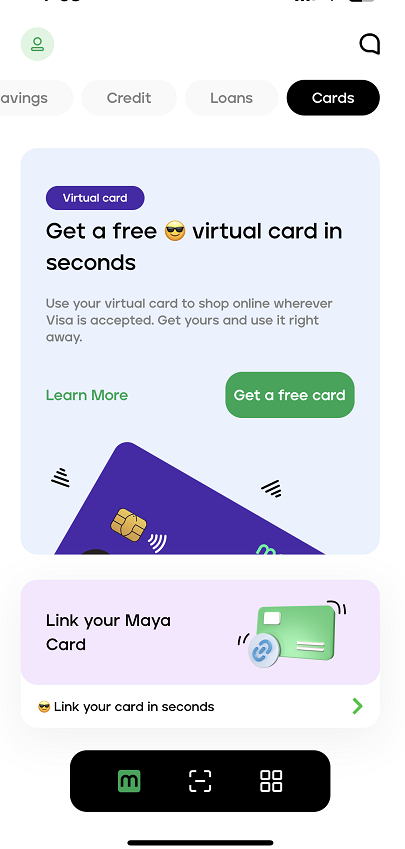

Option 5: PayMaya Virtual Card for Online Purchases

Although not a direct method to convert PayMaya funds into physical cash, using the PayMaya virtual card for online purchases can indirectly provide you with the value of your PayMaya balance. The virtual card allows you to make secure and convenient online transactions, enabling you to purchase goods and services from various online merchants. By using your PayMaya balance for online shopping, you can effectively utilize the funds stored in your PayMaya account without the need for cash conversion. This option is particularly useful if you prefer to make purchases online or if you need to pay for goods or services that do not accept cash payments.

Option 6: Avail of PayMaya Cashback Promotions

PayMaya often runs cashback promotions in collaboration with partner merchants, allowing users to earn cashback rewards when they make transactions. While not a direct method to convert PayMaya funds into physical cash, availing of these cashback promotions can provide you with additional funds that you can use for future transactions or convert into cash through other withdrawal methods. By taking advantage of cashback offers, you can maximize the value of your PayMaya balance and potentially earn extra cash that can be used or withdrawn as needed.

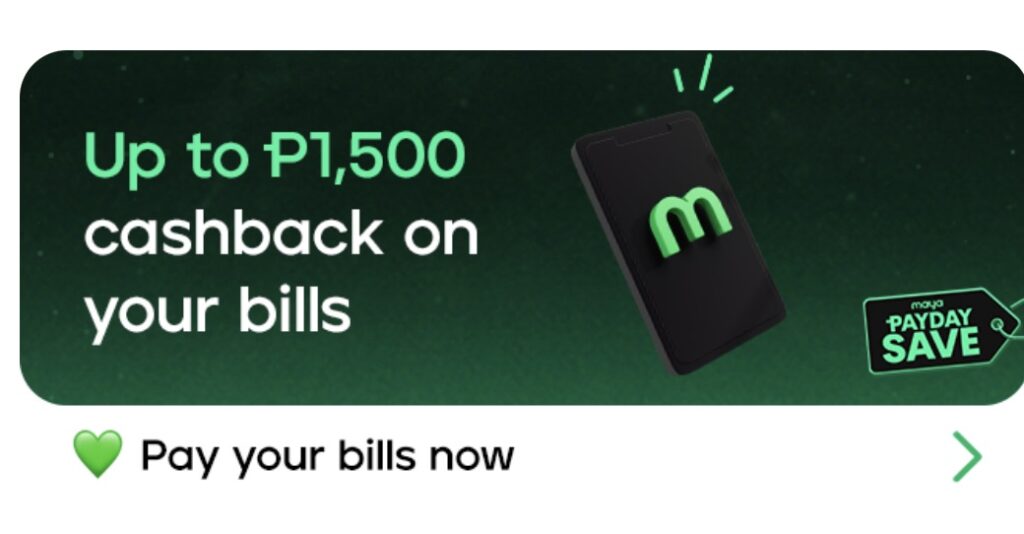

Option 7: Use PayMaya for Bill Payments and Utilities

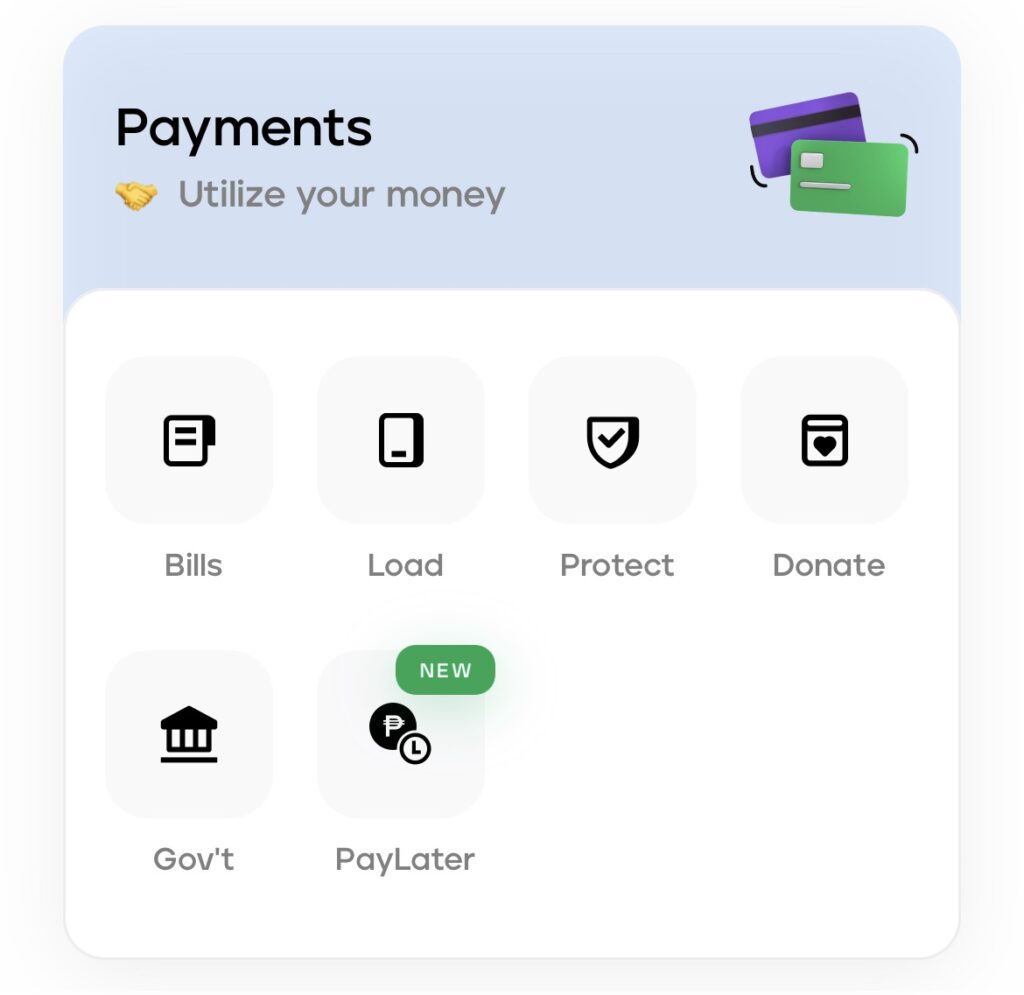

Instead of converting your PayMaya balance into physical cash, you can use the funds for bill payments and utilities. PayMaya allows users to conveniently settle bills for utilities, telecommunications, credit cards, and more through the app. By utilizing your PayMaya balance for bill payments, you can effectively utilize the funds stored in your account without the need for cash conversion. This option offers convenience and flexibility, allowing you to manage your expenses digitally and avoid the hassle of cash transactions.

Option 8: PayMaya Instant Withdrawal

PayMaya also introduced a feature called “Instant Withdrawal” that enables users to withdraw cash from their PayMaya accounts through select partner merchants. This method allows users to initiate a withdrawal transaction using the PayMaya mobile app, and then visit the designated partner merchant’s location to receive the cash instantly. The funds are typically disbursed over the counter, eliminating the need for additional steps or waiting periods.

While PayMaya is primarily designed for cashless transactions, there are several options available to convert your PayMaya balance into physical cash when necessary. Whether through the PayMaya physical card, bank transfers, cash-out at partner establishments, or peer-to-peer cash transfers, PayMaya users have flexibility and convenience in converting their digital funds into cash. It’s important to consider any applicable fees or charges associated with each withdrawal method and choose the option that best suits your needs. With the range of withdrawal options available, PayMaya users can easily access their funds in cash form, providing financial versatility and convenience in their everyday transactions.