Best Credit Cards for Students in the Philippines?

Credit Cards are seen as a sign of maturing and adulting for young adults. When you are seen with one, people often see you as an adult because this card may mean financial freedom.

What is a Credit Card?

However, most people especially students, still don’t know what or how a credit card is used. So, let’s start there: What is a Credit Card?

As defined by Investopedia, it is “[a] thin rectangular piece of plastic or metal issued by a bank or financial services company that allows cardholders to borrow funds with which to pay for goods and services…”.

Such cards are given with the condition that users give back the funds they borrowed.

It is also worth noting that Credit Cards do charge interest for the money spent. You may have heard of 0% interest payments when shopping at malls– such events mean that spending the money on your card would not charge any interest when paid later.

Being issued a credit card also comes with its own perks, although this may differ per financial institution. Now that we have defined what a credit card is, let us talk about how it differs from a debit card.

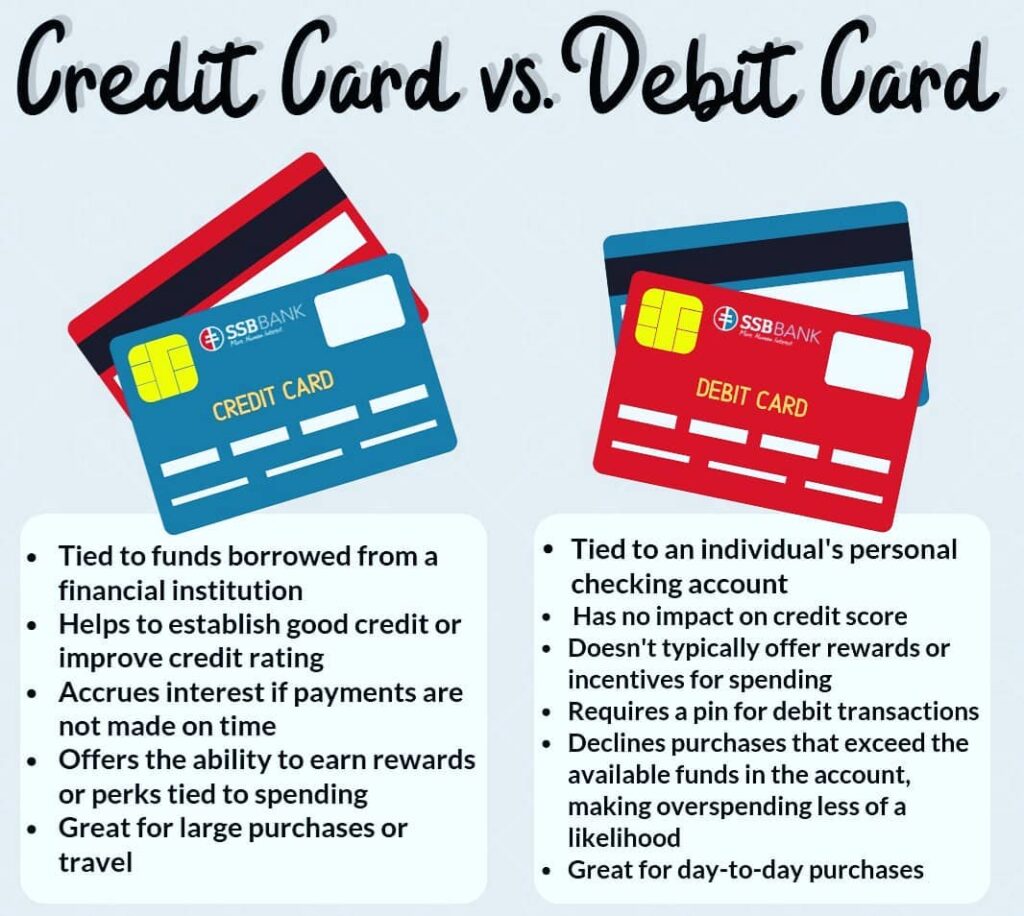

Credit Card vs Debit Card

For Business students, credit and debit are familiar words. Defining it is confusing but to make a long story short– Debit is money from you, Credit is money from the bank. When using a Debit Card, the money spent is deducted from the money on your account.

Using a Credit Card will let a bank lend you money for the things you spent and allow you to pay for it later instead. Let us go further and talk about the pros and cons of both.

Like mentioned, Credit Cards allow cardholders to borrow funds from the bank while Debit Cards deduct money from your bank.

One advantage with Credit Cards are the numerous rewards, travel points, and discounts available at the biggest malls in the country while Debit Cards help students like us avoid debt accumulation.

One of the biggest cons with both is that Credit Cards can lead to debt while Debit Cards will not help us build credit. Building Credit is important for working students mostly as this would reap so many rewards that can be used outside school.

Building Credit is also important for students in general as it gives us both the freedom to pay for our own stuff and a learning activity that would help us for the rest of our lives.

Keeping and building your credit is letting a bank know that you are responsible with money and therefore would be able to pay future funds consistently.

Lastly, Credit Cards offer a greater protection against fraud– something everyone would want to avoid. You can check out Investopedia’s graphic below for better understanding.

It is also worth noting that getting approved for your first ever Credit Card is a process, to say the least. Some of the things banks may be looking for are:

- Government-issued ID like Passports, SSS IDs, etc.

- Proof of Income like your Latest Income Tax Return (ITR)

There are also Secured Credit Cards where banks will only let you open a Credit Account as long as you have a Debit Account with them. This process will bypass the need for proof of income as the bank will be pulling the money from your Debit Account instead.

Top Credit Cards for Students in the Philippines 2022

Now that we have discussed the basics, let us now move forward to the Best Credit Cards for Students. Our criteria for this list would be how easy it is to set-up, little to no income requirements, and low annual fees.

Banco De Oro (BDO)

One of the top 5 banks in the country. It is partnered with the biggest chain of shopping malls in the country– SM Malls.

SM Malls currently has a total of 76 malls around the country with an additional 16 to be opened eventually. Availing a Credit Card with their bank allows easy access to everything, essentially. As SM Malls have said, they got it all for you!

BDO ShopMore Mastercard

Get a free Free SMAC and earn higher Rewards Points for your purchases. Plus, enjoy Rebates and freebies from your favorite retail brands. Rewards include:

- Free SM Advantage Card

As students are frequent shoppers, having an SM Advantage Card will allow them to collect points as well as credit when used with their BDO ShopMore Mastercard.

- Earn Peso Points

BDO currently has a promo running until the end of the year that allows their BDO ShopMore Mastercard cardholders to earn two (2) Peso Points for every 1000 PHP spent. The Peso Points are kept on the Free SM Advantage Card given. Accumulating these Peso Points will allow you to use them for payment at any SMAC Partner Stores like SM Department Store.

- Up to 10% Cash Rebate

Save more when you shop on select days and weekends at any SM Store. My most familiar example would be SM’s infamous 3-day sale where SMAC users are given an additional % off the total on top of the discounts available inside the store. Using your BDO ShopMore Mastercard will also allow you to get a % of your total back.

Eligibility Criteria:

- Cardholders Age

- Principal Cardholder must be 21 to 70 years old.

- Supplementary Cardholder must be at least 13 years old.

- Permanent Resident of the Philippines for at least 2 years

- Minimum Gross Fixed Annual Income of 260,000. This would be around 22,000 a month.

- Employment for at least 2 years

- Regular Employee

- Self-Employed

- Landline Phone

- Address must be within a BDO Branch.

Set-up Difficulty: Easy– There is an online form to be answered.

Income Requirements: 22,000/month

Annual Fees: 125/month, Free on 1st

Apply here.

Metrobank

Metrobank is the second largest bank in the country and their branches are available around the country.

However, their ATMs are more spread than their branches. Despite this, availing a Credit Card with Metrobank is still accessible.

As students, we can only avail a Secured Credit Card with Metrobank. The starter card will provide a good start for you to build your credit history.

However, you would still need to open a Savings Account or a Time Deposit Account with a hold-out deposit.

Some of Metrobank’s Credit Cards students may benefit the most from are:

Metrobank M Free Mastercard

Like PSBank Credit Mastercard, Metrobank M Free Mastercard is also marketed as a credit card without the annual fees for life.

Aside from the usual benefits like it being a contactless card and the embedded chip card that protects its cardholders from fraud, the following are also its benefits:

- Pre-made Table of Fees and Rates for cardholders’ easy access.

- 0% Installment for a wide range of merchant establishments.

- Easily pay for the following with your PSBank Credit Mastercard:

- Bills2Pay – Utilities

- Balance Transfer – Installment Payments at low interest rates

- Cash Rush – Instant Cash via ATMs

- MTXT – Balance Inquiry via text.

- Payment Channels – Credit Card Bill

- MSOA – Statement of Accounts made easy to access

- M Connect – Automated voice, text, and email confirmation for payment.

The biggest difference between the two would be the added discounts and benefits for Metrobank M Free Mastercard cardholders at M Here partner establishments.

Set-up Difficulty: Hard– You need to open another account before getting your credit card. However, this is practical as you would have no debt.

Income Requirements: NOT AVAILABLE

Annual Fees: NOT AVAILABLE

Apply for Metrobank M Free Mastercard here. Learn more about it here.

PSBank Credit Mastercard

PSBank Credit Mastercard is marketed as a credit card without the annual fees for life.

Aside from the usual benefits like it being a contactless card and the embedded chip card that protects its cardholders from fraud, the following are also its benefits:

- Pre-made Table of Fees and Rates for cardholders’ easy access.

- 0% Installment for a wide range of merchant establishments.

- Easily pay for the following with your PSBank Credit Mastercard:

- Bills2Pay – Utilities

- Balance Transfer – Installment Payments at low interest rates

- Cash Rush – Instant Cash via ATMs

- MTXT – Balance Inquiry via text.

- Payment Channels – Credit Card Bill

- MSOA – Statement of Accounts made easy to access

- M Connect – Automated voice, text, and email confirmation for payment.

Set-up Difficulty: Hard– You need to open another account before getting your credit card. However, this is practical as you would have no debt.

Income Requirements: NOT AVAILABLE

Annual Fees: NOT AVAILABLE

Apply for PSBank Credit Mastercard here. Learn more about it here.

LANDBANK

LANDBANK is a government-owned bank with a special focus on serving the country’s fishers and farmers. The bank is officially classified as a Specialized Government Bank but has a universal banking license.

LANDBANK Credit Card

Divided into three (3) groups which serve individuals and businesses, LANDBANK Credit Card has the least minimum annual income required, making it the best option for working students.

However, there is an annual membership fee worth 1000 PHP and 2500 for Classic and Gold type of Cards, respectively. It is also worth noting that there is a free annual membership for your first year. Below are just some of the added benefits:

- 2% Interest Rate

- Wide Acceptability– LANDBANK is accepted worldwide across different stores.

- Card Acceptance– As LANDBANK partnered with Mastercard, the LANDBANK Credit Card is accepted in different local and international stores.

Set-up Difficulty: Medium. You are able to download their application and consent forms online.

Income Requirements: NOT AVAILABLE

Annual Fees: NOT AVAILABLE

Learn more about LANDBANK Credit Card here. Download the application and consent forms here.

Key Takeaways

In conclusion, the first step in this adulting process is extremely hard yet banks have solutions for our problems.

Their Secured Credit Cards allow us students to build our credit and make a steady income first before giving us a proper Credit Card.

Personally, I would apply with BDO as they’re the most accessible nationwide. SM Malls are everywhere and it will surely have a BDO Branch within it. As a student, having financial freedom is a dream.

Being able to buy what you classify as a need is something every student dreams of doing. By providing just 5 of the tens and possibly hundreds of Credit Cards available, I hope this article was able to help you.

Read More:

Best Educational Plans in the Philippines

Lazada vs. Shopee: Which is Better in the Philippines?