Top Visa Mastercard Prepaid Cards Philippines

Prepaid cards are gaining more and more popularity. They’re easy to acquire and convenient to use. You can use them to pay in booking your flights, dining and shopping cashless, making purchases online, and buying tickets without the hassle of background check of credit cards. They’re accepted as payment in many stores especially online and/or those that are located abroad.

So what is it a prepaid card and how can you get one? And how is it different from other cards issued by Philippine banks such as a gift card or credit card? This article is going to talk about why it can be another seamless payment option for your many purchases in virtual or physical business establishments.

What is a Prepaid Card?

A prepaid card has the convenience of the debit card and credit card as an acceptable mode of payment in leading stores and businesses nationwide and internationally without the hassle of opening an account of the former and the background check of the latter. It comes in varieties that bear different payment gateway logos such as BancNet, Mastercard and Visa. Hence, it can be utilized to pay bills and cashless shopping in stores or wherever electronic payments are accepted like restaurants, groceries, parks, booking flights, department stores, amusement centers, e-commerce websites, etc.

It is similar to a gift card. The only difference is that it is reloadable multiple times and the only way it can be rendered useless is when it has reached the expiry date. See below the table that spells out the difference between these cards.

| CARD | RELOADABLE | ACCOUNT | WIDTHRAW |

|---|---|---|---|

| Gift card | No | No | Depends |

| Prepaid card | Yes | No | Depends |

| Debit card | Yes | Required | Yes |

| Credit card | Credit limit | Required | Yes |

How to Buy and Use the Prepaid Card?

You can purchase prepaid card from banks. Others are offered by businesses such as GCash, PayMaya, Smart Money, PayPal and Cebu Pacific. Purchase cost can vary. To be able to use it, you need to put money into it at the outlet, branch via over-the-counter transaction, through deposit ATM (such as the yellow machines of BPI for instance), phone banking or through internet banking via online electronic fund transfer from your bank account.

Once it’s funded, it can now be used as mode payment and can be re-loaded when the balance gets nearly depleted. It can be used in card swipe machine found in point-of-sale (POS) terminals in grocery and shops. And online when you’re booking flights or paying for services, you’d be required to input the information on the card.

- Signature

- Card info

- PIN

- Account number

To keep track of the remaining balance on the card, banks might have an online link or SMS notification where you can make a quick balance inquiry. Alternatively, some banks allow you to know the balance via an ATM, through bank inquiry, or calling a dedicated customer service hotline.

Advantages of Prepaid Cards

What are the benefits when you have a prepaid card?

- Easy purchase. You can buy a prepaid card from your preferred bank that issue them. A bank account is not necessary, so there are no background checks or documents that are required. Generally, you’ll be asked to present at least one valid identification card. The transaction usually takes minutes, and the card can be had within days or weeks depending on your location and the bank’s turnaround time.

- Reload. If your bank offers and has a robust online portal, loading the card with funds may be easy. You can just transfer money from your bank account to your card. No need to go a bank or use an ATM. Another popular choice is to go to loading stations.

- No maintaining balance. The card is not tied to a deposit account. There is no required maintaining balance so you’re not penalized with any charges when the fund falls below a certain level. And it can go on stretches of time that it has minimal or does not have any amount in it (zero balance) without incurring any fees.

- Convenience. It is very easy because you don’t have bring around wads of bills especially when you’re about to purchase big-ticket items. Besides, it is a good (and in a few situations even better) cash substitute. It is durable and easily fits in wallets and pockets. Many businesses accept them as payment.

- Widely accepted. The prepaid card, depending on the BancNet, Visa or Mastercard logo, is an accepted form of payment in many virtual or real business establishments. Just make sure that your fund is enough or exceeds the amount of the product or service you’re about to purchase.

- Rebates and perks. Some prepaid cards allow you to accumulate points in exchange for rebates, perks, and other privileges.

Disadvantages of Prepaid Cards

And what are the risks and disadvantages when using prepaid cards?

- Withdrawal issues. By the time your money is loaded into it, either you get charged when you want to get it back or you’re not allowed to convert it back to cash, and the only way to use your fund is to spend it.

- Expiry. It is only valid up to a certain number of years. Others also charge an amount on third and fourth year of validity. Once it expires, it loses the ability to transact. Any remaining balance can be transferred over to a new card subject to terms and conditions.

- Purchase cost. You can purchase the prepaid card from the banks or any participating retailers at a cost. Upon the card’s expiry, it cannot be renewed. Instead, a new card has to be purchased.

- Transaction fees. It has many miscellaneous fees on various transactions. There can be a loading fee whenever you put money into it, withdrawal charges when you get the money back, a fee when you want to know its remaining balance, etc. Aside from that, there may be fees associated with purchases made on stores from abroad, and that’s on top of paying whatever is currency exchange rate at the time of transaction

- No interest. Because it is not considered a bank account, its balance does not earn any interest and is not covered with insurance through the Philippine Deposit Insurance Corporation.

- Loading limit. You’re restricted from putting too much money into it. Some cards allow balances from ₱10,000 up to ₱100,000, which then makes it necessary to reload. This can be an issue with frequent big purchases that deplete the balance quickly.

What is the Cheapest Prepaid Card?

Which prepaid cards are free? As indicated in the table below, the cost of getting PSBank Prepaid Mastercard and PNB Prepaid Mastercard is zero as it is waived when you load it up with at least ₱500 initial fund. Five other cards can be acquired for ₱100: EastWest Prepaid Card, Equicom Cash Card, LANDBANK Cash Card, SMART Money Card and UCPB VISA eMoney Card.

| TYPE | LOGO | COST | LIMIT | MAX |

|---|---|---|---|---|

| PSBank Prepaid Mastercard | Mastercard | 0 | 100,000 | 500,000 |

| PNB Prepaid Mastercard | Mastercard | 0 | 100,000 | 100,000 |

| EastWest Prepaid Card | Visa | 100 | 100,000 | 100,000 |

| Equicom cash card | Visa | 100 | 50,000 | 100,000 |

| LANDBANK Cash Card | Visa | 100 | 100,000 | 100,000 |

| SMART Money Card | Mastercard | 100 | 10,000 | 50,000 |

| UCPB VISA eMoney Card | Visa | 100 | 100,000 | 100,000 |

| Bayad Center Card | Visa | 110 | 100,000 | 100,000 |

| BDO Cash Card | Mastercard | 150 | 10K to 100K | 100,000 |

| BPI ePay Mastercard | Mastercard | 150 | 100,000 | 500,000 |

| CEB GetGo Prepaid Card | Visa | 150 | 250,000 | 500,000 |

| GCash Mastercard | Mastercard | 150 | 100,000 | 100,000 |

| RCBC MyWallet Visa Prepaid Card | Visa | 150 | 100,000 | 100,000 |

| USSC Prime card | Visa | 150 | 200,000 | 200,000 |

| BPI Amore | Visa | 200 | 100,000 | 500,000 |

| PayMaya Visa EMV Card | Visa or Mastercard | 250 | 100,000 | 100,000 |

| Metrobank Yazz Card | Visa | 300 | 10,000 | 100,000 |

| PLDT Smart MVP card | Visa | not specified | 100,000 | 100,000 |

| Sterling Bank of Asia ShopNPay prepaid | Visa | not specified |

Which Prepaid Card Does not Allow Withdrawal?

Of all the prepaid cards, only BPI Amore Visa Card does not have the functionality to allow funds to be withdrawn via ATM or over-the-counter transaction.

Top Prepaid Cards in the Philippines

The prepaid cards that are included in this article are those cards that bear either Visa or Mastercard. They’re issued by banks and other financial institutions such as GCash, USSC, PayMaya, and Bayad Center. Some of them have functionalities that are extended beyond bills payment and cashless shopping.

Most of them can be used as ATM card with the ability to withdraw funds, as loyalty card, and as rewards card. These cards are arranged in alphabetical order.

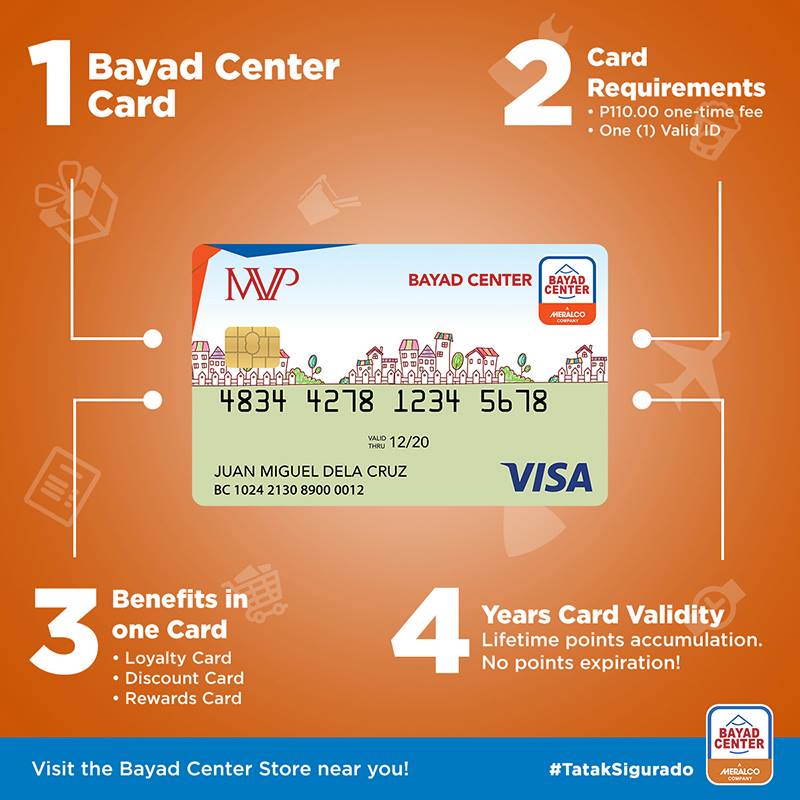

1. Bayad Center Card

The Bayad Center Card is a Visa logo-bearing card that you can purchase at any Bayad Center location nationwide for ₱110. It is multi-functional. As a loyalty card, you can earn points for when paying bills (1 point per bill payment). As a rewards card, you can enjoy rewards, discounts, and other perks in many business establishments. When link to a PayMaya account, you can use it to send/receive money from other Bayad Center cardholders as well as withdraw from any BancNet ATMs. And lastly, it can be used as payment wherever Visa is accepted.

How to get the Bayad Center Card

- Prepare ₱110 and valid ID.

- Visit any Bayad Center branch.

- Fill out the form, load up the card with funds and you can already use it.

2. BDO Cash Card

You can shop with BDO Cash Card wherever Mastercard is accepted. It comes in three varieties: pre-embossed (maximum loading limit of ₱10,000 with dormancy after 180 days without activity), retail embossed (₱25,000 and dormancy at 360 days), and corporate embossed (₱100,000 and dormancy at 360 days). Any financial transaction such as reloading or withdrawal can lift the dormant state.

| TRANSACTION | CHARGE |

|---|---|

| BDO ATM inquiry | FREE |

| BDO ATM withdrawal | 2.00 |

| Non-BDO withdrawal | 11.00 |

| Non-BDO balance inquiry | 2.00 |

| POS inquiry and purchase | FREE |

There are also limits set for any purchases depending on the electronic channel that they’re made from.

| CHANNEL | LIMIT |

|---|---|

| BDO ATM Withdrawal | Maximum per day: 50,000.00 Maximum per transaction: 10,000 Minimum per transaction: 200 |

| POS purchase (max per day) | PIN: 50,000 Signature: 50,000 Contactless: 2,000 |

| E-Commerce/Online Purchase Transaction | Maximum: Php 50,000 |

How to buy BDO Cash Card?

- Prepare ₱150 and one valid ID.

- Visit any BDO branch nationwide and fill out the form.

- Wait for 3-5 business days for delivery within Metro Manila and 5-7 business days outside the capital.

3. BPI ePay Mastercard

The BPI ePay Mastercard is one of two prepaid cards offered by the Bank of the Philippine Islands. You can have one for only ₱150, and there are no fees for balance inquiry or re-loading of funds. Withdrawal is permitted subject to a fee. With validity of four years, you’d be required to pay ₱99 each for the last two years. Whenever the card expires and it has remaining balance that you want to transfer over to the new card, a monthly maintenance fee computed starting on 121st day from expiry date is charged.

How to buy the BPI ePay Mastercard?

- Drop by any BPI branch or fill out the online application form.

- Present one valid ID.

- Pay ₱150 for the card.

- Wait for the delivery of the card as notified through SMS.

- Go to the branch that you’ve selected as drop-off and claim your card.

4. BPI Amore Visa Prepaid Card

BPI Amore Visa Prepaid Card is the other prepaid card that is powered by Visa. It is up for grabs for ₱200, and with an additional ₱50 you can activate beep services for MRT, LRT, and BGC bus rides. It has a validity of four years, with a charge of ₱99 on the third and fourth year. Re-loading and balance inquiry are free. However, you can’t make any withdrawals.

Cardholders can earn points for every ₱200 spent in a single transaction. You can inquire about your points via SMS, and the instructions are found on rewards programs that also contain a catalog of discounts. Moreover, you’re entitled for other perks such as free access to Ayala Malls Customer Lounge, 5% off on movie tickets, and invitation to exclusive cardholder events (subject to terms).

How to buy the BPI Visa Prepaid Card?

- Drop by any BPI branch or fill out the online application form.

- Present one valid ID.

- Pay ₱200 for the card or ₱250 with beep service.

- Wait for the delivery of the card as notified through SMS.

- Go to the branch that you’ve selected as drop-off and claim your card.

5. CEB GetGo Prepaid Card

The CEB GetGo Prepaid Card issued by the Cebu Pacific through the GetGo program combines the features of a loyalty card and the convenience of a prepaid card. It can hold nine currencies such as Philippine Peso (PHP), United States Dollars (USD), Singapore Dollars (SGD), HongKong Dollars (HKD), Australian Dollars (AUD), Japanese Yen (JPY), Euro (EUR)

British Pound (GBP), and Canadian Dollars (CAD). However, only Philippine peso can be used when loading up the card.

Additionally, every 1 reward point is earned for every ₱100 spending. and the accumulated points which can be used to avail of discounts when booking flights with Cebu Pacific and shopping or dining at other participating business establishments. You can also transfer funds to other Ceb GetGo Prepaid Cards for a fee of ₱20.

How to buy Ceb GetGo Prepaid Cards

- Prepare ₱150 and valid ID.

- Visit any of the following businesses: Robinsons Department Store, Ministop, Select 711 stores, FamilyMart and NCCC Malls.

- Fill out the form.

- Load the card. Fees that vary with the loading store apply.

6. Equicom Cash Card

The Equicom Cash Card is a Visa card issued by the Equicom bank. The dormant state starts on the 13th month without activity and automatically activates the maintenance fee of ₱200 every month until the fund is depleted.

How to apply for Equicom Cash Card

- Prepare ₱150 and valid ID.

- Visit any Equicom bank branches nationwide.

- Fill out the form.

- Load the card and then you can use it.

7. EastWest Prepaid Card

The East West Prepaid Card has a Visa logo and is accepted in many major online and real stores. Aside from online shopping and paying bills, it can be used to accept remittance from other countries. A registration using the card number is also optional for online banking. ATM withdrawal and POS purchases per day is ₱50k, while the limit for ATM withdrawal per transaction is set at ₱20k. Renewal of the card also comes free subject to terms and conditions.

| TRANSACTION | CHARGE |

|---|---|

| Balance inquiry | ₱1.00 using bank or other bank’s ATM ₱45.00 using VISA ATM Terminal (Domestic or Abroad) |

| Withdrawal | ₱10.00 using ATMs after 3 withdrawals in a month ₱11.00 using non-EWB ATM ₱157.50 using VISA ATM Terminal (Domestic or Abroad) |

| Dormancy | ₱50 or the remaining balance whichever is lower |

How to order the EastWest Prepaid Card

- Prepare ₱100 and valid ID.

- Visit any EastWest Bank branch nationwide.

- Delivery of the card through the branch is three days in Metro Manila and five banking days otherwise.

8. GCash Mastercard

The GCash Mastercard is a prepaid card that you can use to cash out money in 20,000 partner ATMs in the Philippines. Just like the others, it can be utilized to pay for shopping on virtual or physical stores.

How to order the GCash Mastercard?

- You have three registration options: through the GCash app, online, or through partner outlets like Ministop, Lawson, All Day, Robinsons Business Centers and participating 7-Eleven stores.

- Prepare ₱150 for the card either on GCash or in cash when buying in partner outlets.

- Required: verified phone number, full name, home address, and delivery address for the shipment of the card.

- Delivery can take up to 10 days. If you’re outside of the coverage area, the card can be shipped to nearest LBC branch.

- Activate the card according to instruction.

9. Landbank Cash Card

The Landbank Cash Card bears the Visa logo and has a validity 3 years. Some of the objectives that it can be purchased for are corporate purposes (employee benefits, loans, pensions, payroll credits, commissions, reimbursements, allowances, bonuses), remittance or payment collection for merchants. There is a ATM and POS limit of ₱50k a day.

How to get a Landbank Cash Card

- Please prepare ₱100 and valid ID.

- Go to any Landbank branch.

- Fill out the form.

10. Metrobank Yazz Card

Metrobank Yazz Card is a Visa card exclusive to anyone 14 years and older who can read and write, and it is available in many participating loading partners such as convenience stores, major department stores through concierge or customer service, etc. Balance inquiry is free online or through phone customer service hotline. A fee is incurred when inquiry is done through an ATM.

| WITHDRAWAL | AMOUNT |

|---|---|

| ATM | Metrobank or PSBank |

| Minimum | 1,000.00 |

| Maximum | 30,000.00 |

How to buy the Metrobank Yazz Card?

- Prepare ₱300 and one valid ID. The card is already pre-loaded with ₱50 but it needs to have a minimum of ₱100 before it can be used.

- Go to a business partner.

- Pay the price of the card and its initial load.

- For more details, check the Yazz Card FAQs for details.

11. PayMaya EMV Card

The PayMaya EMV Card comes in two varieties: Visa or Mastercard. You can choose the logo upon ordering it through the online store. You can use it standalone or you can enroll the card on your PayMaya wallet. There is no fee when re-loading through partners or you pay 1.5% of the amount when loading from Smart Money or Smart Padala.

How to order the PayMaya Visa EMV Card?

- Visit PayMaya store and add the prepaid card to cart. Choose between Visa or Mastercard.

- Check out, fill out the application, and pay.

- Prepare ₱200 and ₱50 for shipping.

- Delivery turnaround time is 3-5 business days for Metro Manila address and 5-10 business days for addresses outside the capital.

12. PLDT Smart MVP card

The PLDT Smart MVP Card is a card exclusive to customers of PLDT and Smart customers. It is a Visa Card that is powered by and shares the same wallet as your PayMaya account. Deals, promos, and other perks are available for those who are able to accumulate points. Points are earned by signing up the accounts of the following companies: PLDT, Smart, Sun, TNT

Cignal, Caltex, Bayad Center, Delos Santos Medical Center, Makati Medical Center, EasyTrip RFID, Smart Ka-Partner and Maynilad. For those who just wants to redeem points, the card is not necessary as the

How to get the PLDT Smart MVP Card

Just visit PLDT or Smart store and request for MVP Card.

13. PNB Prepaid Mastercard

The PNB Prepaid Mastercard is one of two prepaid cards issued by PNB. Powered by Mastercard, it can be acquired personalized or otherwise. You can own multiple cards, and transactions can be requested via the customer service hotline. Fund transfer, bills payment, reload, balance inquiry and withdrawal are free for as long as you’re utilizng the bank’s facilities. Transactions performed in non-PNB banks may incur charges.

| TRANSACTION | CHARGE |

|---|---|

| Withdrawal on BancNet ATM | 11.00 |

| Inquiry on BancNet ATM | 2.00 |

| Top-Up at PNB Branch | 20.00 |

| (Abroad) Withdrawal | 150.00 |

| (Abroad) Inquiry | 75.00 |

| International purchases | up to 3% |

How to get PNB Prepaid Mastercard?

- Prepare ₱250 for personalized card or ₱150 for non-personalized card.

- Go to any PNB branch.

- Fill out the form.

- Wait for the card.

- Put money into the card and change the pin. It can then be used.

14. PNB Prepaid Card

The PNB Prepaid Card is a prepaid card from PNB that is accepted at an ExpressNet, MegaLink or BancNet ATMs nationwide. It costs ₱100 to get the card although this can be waived when the initial load is at least ₱5,000.

How to get PNB Prepaid card?

- Prepare ₱100 or just prepare ₱500 as initial fund so that the card is free. Also make sure that you have a valid identification card.

- Go to any PNB branch.

- Fill out the form.

- Wait for the card.

- Load up and change the pin. You may now use the card.

15. PSBank Prepaid Mastercard

The PSBank Prepaid Mastercard comes free when you load it up with a minimum of ₱500 according to this blog. Upon expiry, a new card can be issued to you free of charge as well. It comes with a PIN (for withdrawal or bills payment), Account Number (for reload, remittance or bills payment), and card number for online shopping.

| TRANSACTION | CHARGES |

|---|---|

| Balance inquiry | Free. Non-PSBank/Metrobank: ₱1 Overseas: $1 |

| Withdrawal | Free. Any PSBank: 50 on ₱100,000 and ₱100 for higher amount. Metrobank: ₱75. Non-PSBank/Metrobank: ₱10. Overseas: $3.50 |

| Reload | Free for PSBank Mobile and Online PSBank branch: ₱10 |

| Fund transfer | ₱25 via ATM InstaPay – ₱15 PESONet – ₱50 |

How to order the PSBank Prepaid Mastercard?

- Prepare initial fund of ₱500 and valid ID.

- Go to any PSBank branch.

- A signed waiver and valid ID of the guardian are required for cardholders who are between 7 and 17 years old.

16. RCBC MyWallet Visa Prepaid Card

The RCBC MyWallet Visa Prepaid Card is a prepaid card from Rizal Commercial Banking Corporation powered by Visa. It shares functionalities of an ATM card since you’re given the ability to withdraw cash as well as it allows you to send money, pay bills and make cashless purchases. Balance inquiry and fund transfer via online banking are free. Other fees and charges are found in this link.

Lastly, the card is considered inactive when there is no financial activity for 12 consecutive months and ₱200 is incurred on the following month.

How to get the RCBC MyWallet Visa Prepaid Card

- Prepare ₱150 and one valid ID.

- Drop by any RCBC branch.

- Fill out the form.

- Load up the card with ₱120, of which ₱20 is the loading fee and the rest forms part of the initial fund.

17. SMART Money Card

The Smart Money Card is a Mastercard-bearing plastic card issued jointly by Banco de Oro and Smart. It can be used as a stand-alone with limited functionality, and an activation by linking it to a Smart mobile phone number activates transactions such as remote payment. Renewal of the card is free and takes 9 days within the capital and 14 days outside of it. Its is 2 years (Instant Card with prefix 529967 and personalized card 557751) or 5 years (Personalized card with prefix 529967). Except for dormant cards, which would require ₱50 to reactivate it.

How to get a Smart Money Card

- Prepare ₱100 and valid ID.

- Go online, visit a Smart Store, or any BDO branch.

- Fill out the form.

- Shipping takes 7 days within Metro Manila or twice as long outside of the capital.

18. ShopNPay Visa Prepaid Card

The ShopNPay Visa Prepaid Card is issued by the Sterling Bank of Asia. It allows you to withdraw or inquire free of charge at any Sterling Bank ATMs. However, using other bank’s ATM would incur ₱1 for every balance inquiry and another ₱10 for successful withdrawal.

How to get the ShopNPay Visa Prepaid Card

- Prepare two (2) valid ID.

- Visit any Sterling Bank and inquire about the cost of the card. No amount is specified on their website.

- Fill out the form and load up the card.

19. UCPB VISA eMoney Card

The UCPB VISA eMoney Card gives you the ability to have global access to cash converted to the currency of the country you’re in, which is great when travelling abroad. There is no fee for dormancy and it can be reloaded at any branches of the bank. Balance inquiry and withdrawal are free with any of the bank’s ATM located nationwide. For details on other fees, you can check this link. Loading up the card needs to be performed over the counter at the bank, which would incur a charge of ₱10.

How to get the UCPB VISA eMoney Card

- Visit any UCPB branch.

- Bring one (1) valid ID and pay ₱100 for the card.

20. USSC Prime Card

The USSC Prime Card is powered by China Bank and Trust Corporation and issued by USSC, a remittance company. You can link the card with the USSC Super Service App that activates the USSC Panalo Wallet for easy facility of sending and receiving money via Wastern Union. You can also personalized the card, just add ₱10 and wait for the delivery of the card within two weeks. The validity of the card is up to 5 years. Withdrawal via CTBC ATMs are free, while non-CBTC ATMs can incur varying fees.

How to get USSC Prime Card

- Prepare the cash (₱150 or ₱160 personalized card) and valid ID.

- Visit any USSC branch.

- Fill out the form and load up the card.