How Does GCash Padala Work?

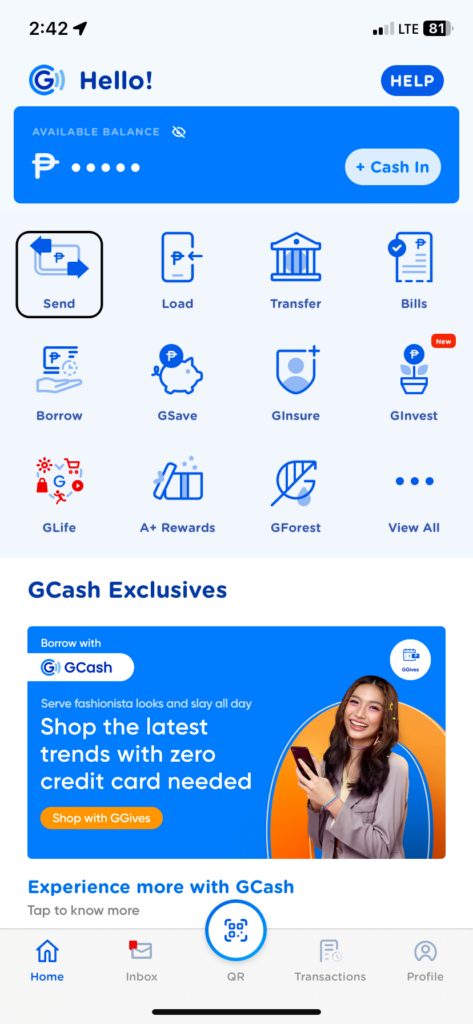

In recent years, mobile payment platforms have revolutionized the way we send and receive money. One such platform that has made waves in the Philippines is GCash. GCash is a mobile wallet that allows users to pay bills, buy load, and send money with just a few taps on their smartphones. In this blog, we will focus specifically on how GCash Padala works.

How Does It Work?

GCash Padala is a service that allows users to send and receive money from anyone, anywhere in the Philippines. It is a convenient and secure way to transfer money without the need for cash. Here’s how it works:

Step 1: Download the GCash App

To use GCash Padala, you first need to download the GCash app. The app is available for free on the Google Play Store and the Apple App Store. Once you’ve downloaded the app, you’ll need to register and create a GCash account. The registration process is straightforward and will only take a few minutes. You’ll need to provide some basic information, including your name, mobile number, and email address.

Step 2: Fund Your GCash Wallet

Before you can use GCash Padala, you need to fund your GCash wallet. There are several ways to do this, including bank transfers, online payment platforms, and physical cash-in at GCash partner outlets. You can also link your GCash account to your bank account and transfer funds directly from your bank to your GCash wallet.

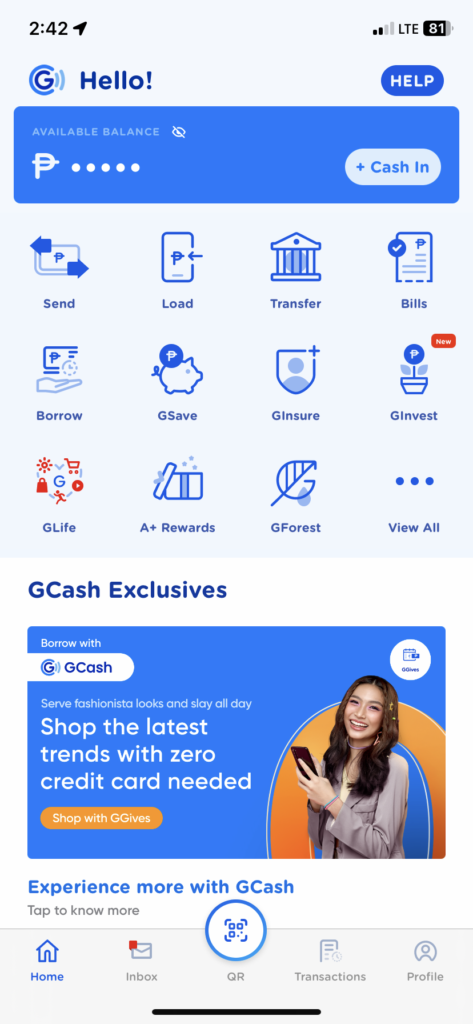

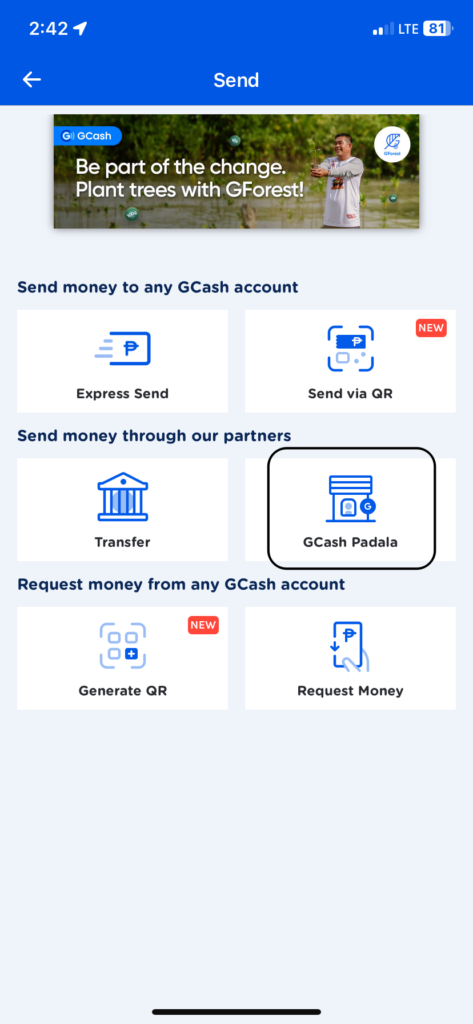

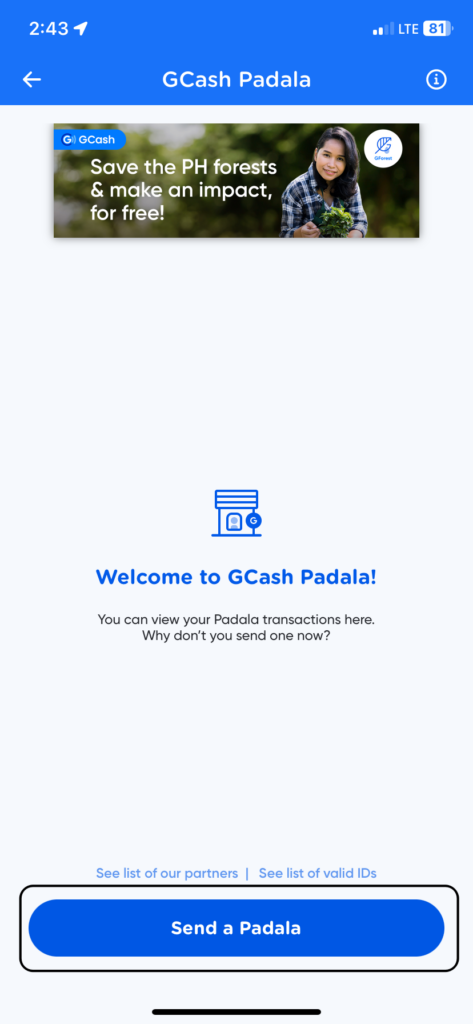

Step 3: Initiate a GCash Padala Transaction

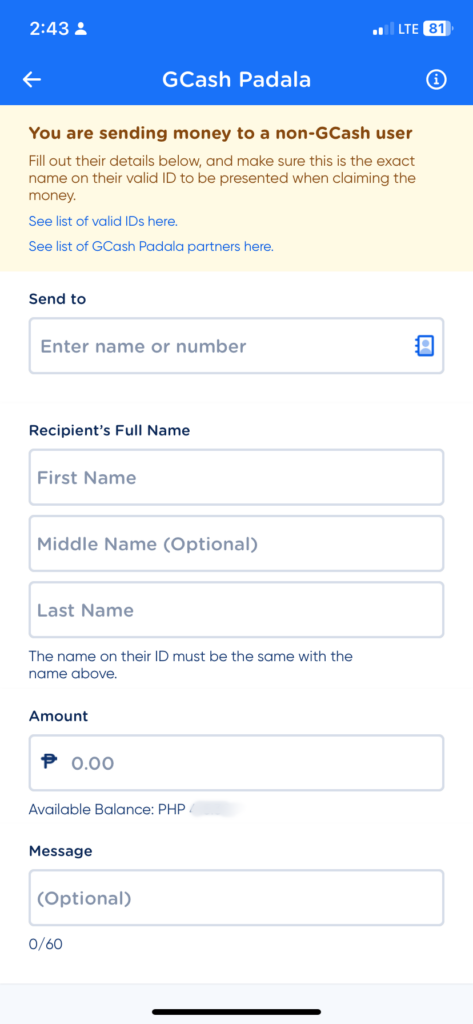

To send money through GCash Padala, open the GCash app and click on “Send Money.”

You’ll be prompted to enter the recipient’s mobile number and the amount you want to send. You can also choose to include a message for the recipient, such as the reason for the transaction.

Step 4: Verify the Transaction

Before you can complete the transaction, you need to verify the details. Make sure the recipient’s mobile number and the amount you’re sending are correct.

You’ll also need to verify your identity by entering your GCash MPIN. Once you’ve verified the details, click on “Send” to complete the transaction.

Step 5: Notify the Recipient

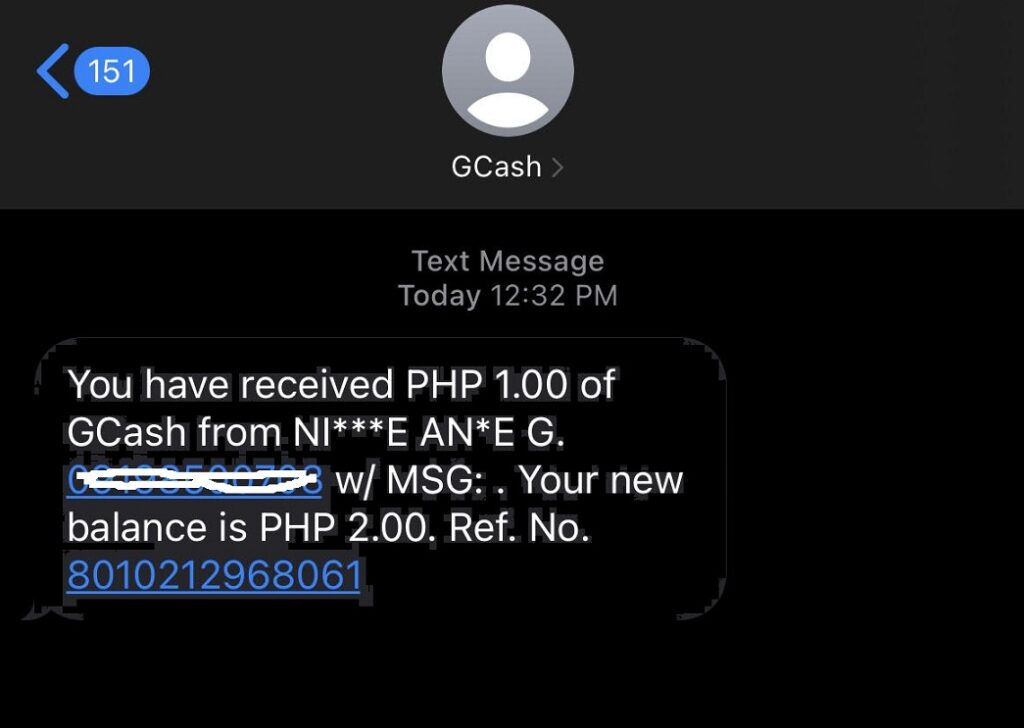

After you’ve completed the transaction, the recipient will receive a text message notifying them of the transfer. The text message will include instructions on how to claim the money. If the recipient doesn’t have a GCash account, they will be prompted to download the app and create an account. If the recipient already has a GCash account, they can simply claim the money by clicking on the link in the text message and following the instructions.

Step 6: Claim the Money

To claim the money, the recipient will need to follow the instructions in the text message. If they don’t have a GCash account, they’ll need to download the app and create an account. Once they’ve created an account, they can claim the money by entering the verification code in the app. If they already have a GCash account, they can simply click on the link in the text message and follow the instructions to claim the money.

Step 7: Withdraw the Money

After the recipient has claimed the money, they can withdraw it from any GCash partner outlet or ATM. GCash has partnered with several banks and payment centers in the Philippines to make it easy for users to withdraw their funds. To withdraw the money, the recipient will need to present a valid ID and the verification code they received in the text message.

How Much Are GCash Padala Fees?

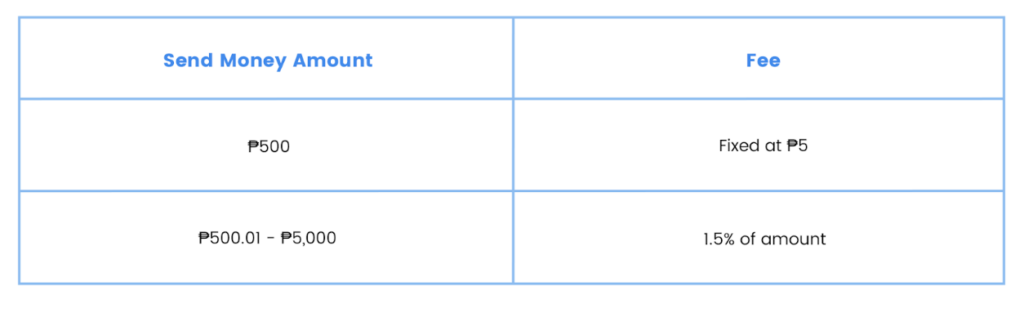

GCash Padala fees vary depending on the amount you’re sending and the payment method you’re using. For example, if you’re sending money through a GCash partner outlet, you’ll be charged a fee of 2% of the total amount you’re sending.

If you’re sending money through a bank transfer, the fee is usually lower, around 1.5% of the total amount. However, fees may also depend on the recipient’s location and the type of transaction being made.

One thing to note is that GCash has a limit on the amount of money you can send and receive. The daily limit for GCash Padala transactions is PHP 100,000, while the monthly limit is PHP 500,000. If you need to send or receive larger amounts, you may need to split the transaction into multiple smaller transactions or use other payment methods.

Benefits of Using GCash Padala

Using GCash Padala offers several benefits over traditional money transfer methods. One of the main benefits is convenience. With GCash Padala, you can send and receive money anytime, anywhere, as long as you have an internet connection. You don’t need to go to a physical bank or payment center to send or receive money.

Another benefit is security. GCash uses advanced security measures to protect users’ accounts and transactions. All transactions are encrypted and verified using MPINs, and GCash regularly monitors accounts for suspicious activity.

GCash Padala also offers lower fees compared to traditional money transfer methods. This makes it a more affordable option for sending and receiving money, especially for smaller amounts.

Use GCash Padala Today!

GCash Padala is a convenient, secure, and affordable way to send and receive money in the Philippines. With just a few taps on your smartphone, you can transfer money to anyone, anywhere in the country.

GCash Padala also offers lower fees compared to traditional money transfer methods, making it a more affordable option for sending and receiving money. If you haven’t tried GCash Padala yet, it’s worth considering as a more convenient and secure alternative to traditional money transfer methods.