How Does GCash Credit Work?

How Does GCash Credit Work?

GCash is a leading mobile wallet app in the Philippines that allows users to make payments and transfer money with ease. One of the key features of the app is the GCash credit facility, which allows users to borrow money and pay it back over a certain period. Today, we’ll take a closer look at how GCash credit works and how you can use it to your advantage.

What is GCash Credit?

GCash credit is a borrowing facility offered by GCash that allows users to borrow money for a certain period and pay it back with interest. The credit limit varies depending on your creditworthiness and your usage of the GCash app. You can use GCash credit to pay bills, purchase goods and services, and send money to other GCash users.

What is the difference between GCash and GCredit?

GCash is one of the most well known mobile application wallets in the Philippines where Filipinos can pay their bills, transfer money, and more. With GCash, you can put in a certain amount of money on your wallet via cash or bank transfer and use it for your preferred purpose. As for GCredit, their difference is that GCash would be lending you some money via GCredit, and you can use the money to pay for your bills and services.

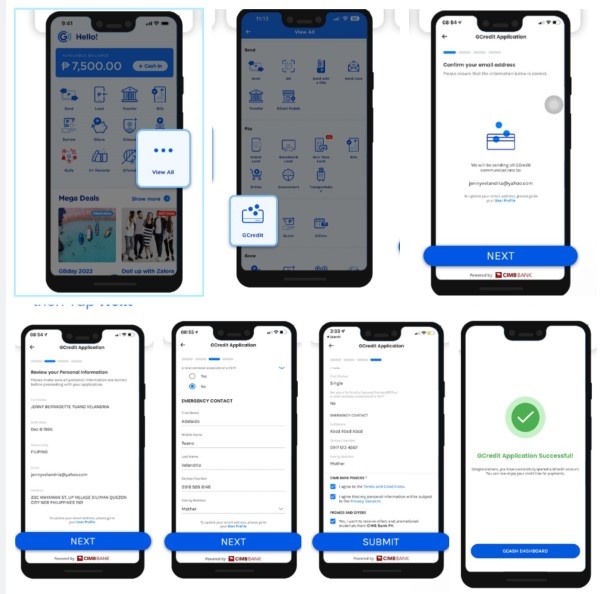

How to Apply for GCash Credit?

To apply for GCash credit, you need to meet the following requirements:

- You must be a verified GCash user with a fully upgraded account.

- You must have a good credit score.

- You must have a regular source of income.

If you meet these requirements, you can apply for GCash credit through the app. Here’s how to do it:

- Open the GCash app and log in to your account.

- Tap the “GCredit” icon on the home screen.

- Tap “Apply Now” to start the application process.

- Fill out the application form and provide the necessary information, such as your name, address, employment details, and monthly income.

- Submit your application and wait for approval.

The approval process may take a few days, depending on your creditworthiness and the completeness of your application. Once your application is approved, you will receive a notification from GCash, and your credit limit will be displayed in the GCredit section of the app.

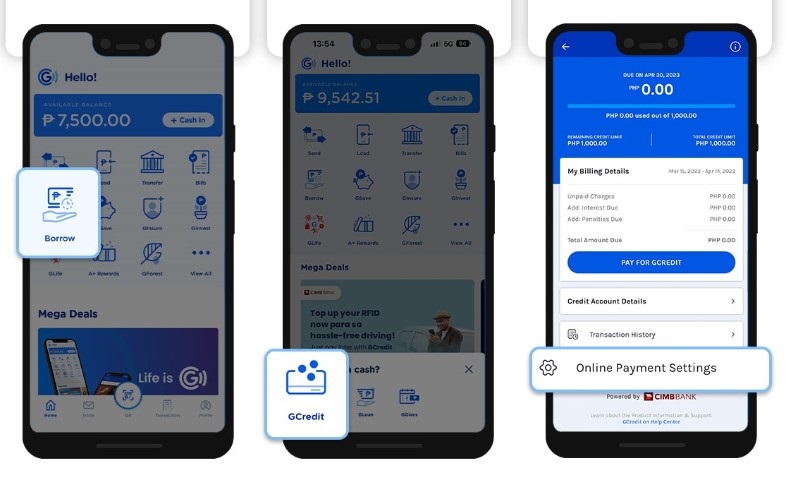

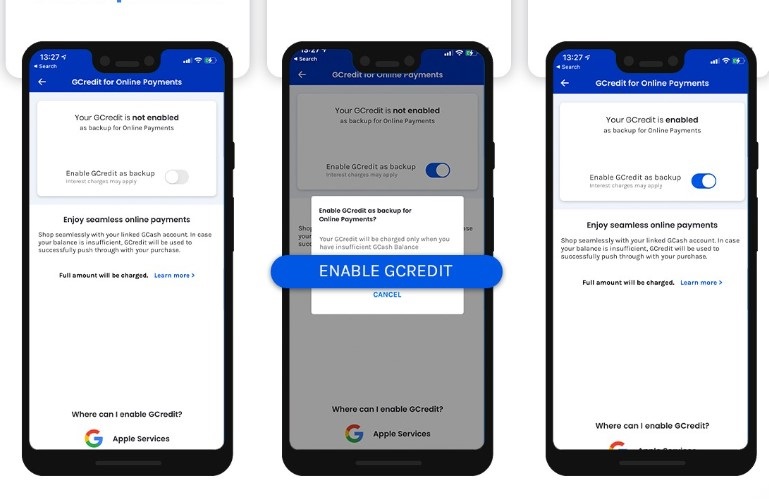

How to Use GCash Credit?

Using GCash credit is not too difficult to do, people of all ages can easily access this via the GCash mobile application.

Here is the step by step procedure on how to use the GCash Credit:

- Open the GCash app and log in to your account.

- Tap the “GCredit” icon on the home screen.

- Choose the amount you want to borrow and the repayment term.

- Tap “Confirm” to complete the transaction.

The borrowed amount will be credited to your GCash wallet, and you can use it to pay bills, purchase goods and services, and send money to other GCash users. You will also receive a repayment schedule showing the due dates and the amount to be paid for each installment.

How to Pay Back GCash Credit?

Once you have successfully gained the credit that you need via GCash credit, it is also important to know how to pay your dues. There are certain ways on how to pay for your dues.

Pay Via GCash App

Paying using the GCash app is the most common method of payment for GCredit. Here’s the step by step procedure on how to do it:

- Open the GCash app and log in to your account.

- Tap the “GCredit” icon on the home screen.

- Tap “Repay” to start the repayment process.

- Choose the payment method and the amount to be paid.

- Tap “Confirm” to complete the transaction.

Pay Via Bayad Center

- Go to any Bayad Center outlet

- Get a Bayad Center Transaction Form

- Fill the form with the following details:

Account Name: (customer’s full name)

Present Address:

Contact number:

Biller: FUSE LENDING

Amount: (amount to be paid)

Account number: (your Fuse registered mobile number without the first 0 of the mobile number – ex. 91712345678)

- Check CASH and write down the amount to be paid

- Sign the form

- Give the transaction form and payment to the Bayad Center representative and wait for a confirmation receipt.

What are the Fees and Charges of GCash Credit?

GCash credit charges a monthly interest rate of 5%, which is lower than most credit card rates in the Philippines. The repayment term can range from 3 to 6 months, depending on the amount borrowed.

The minimum amount you can borrow is PHP 3,000, while the maximum amount can go up to PHP 30,000, depending on your creditworthiness.

There are also other fees and charges that you need to be aware of, such as the processing fee, which is 5% of the borrowed amount, and the late payment fee, which is 5%

Can I cash out using GCash Credit?

Yes, you can definitely cash out using GCash Credit. What you can do is to visit any BancNet or any affiliated ATM and GCash Partner Outlet like 7/11. If you see a logo of Mastercard or BancNet on the machine, you can continue to get your cash.

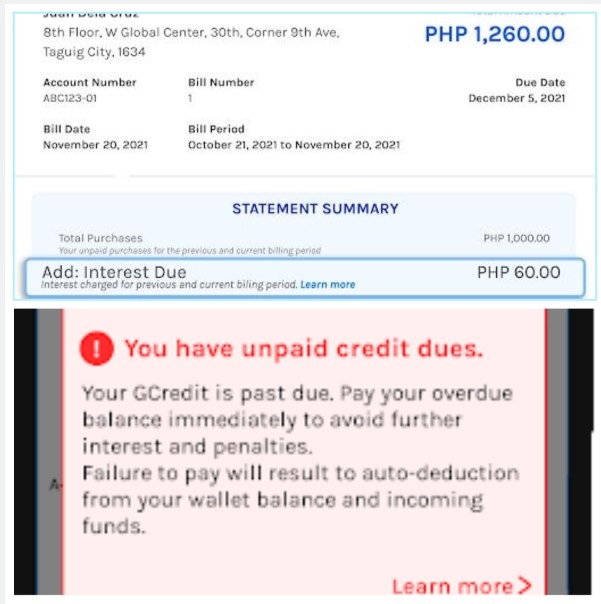

What happens when I don’t pay my GCredit?

There are specific due dates once you use GCredit, and there will also be consequences once you don’t pay your debts on time. Your GCredit account may be suspended, which means that you might not be able to use your GCredit account to pay your bills or shop online.

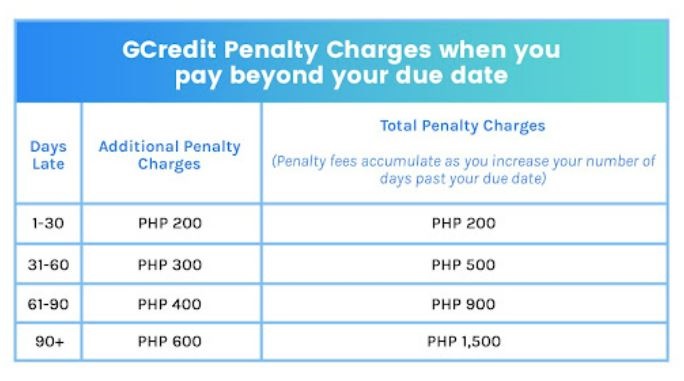

Additionally, you would also be charged with penalty fees, and this fee would depend on the number of days when you have not paid your GCredit after your due date.

Is GCash credit safe?

Yes, guaranteed. Anyone can get a secured credit line without worrying about identity and digital theft. GCash has secured bank partners and it is also regulated by the Bangko Sentral ng Pilipinas.

Make Use of Your GCash Credit Efficiently

Now that you know how GCash Credit works, you can now start using it for your own convenience. Just make sure to be financially disciplined and pay your dues before you get any penalties. Happy crediting!