What are the Best Personal Finance Website Blogs in the Philippines?

Aside from PESOLAB, what personal finance blogs you can follow right this minute?

These are websites that made it their mission to spread financial literacy to fellow Filipinos. They talk about topics such as how to make, save, borrow, grow and protect your hard-earned money. In fact, most of the stuff that you’d read will be about starting the habit of saving, budgeting, and earning passive income. Most of all, they’d teach you ways to build a future where you’d be living a life of financial freedom.

In short, they’re here to help you become better, more contented, and hopefully wealthier.

28 Personal Finance and Financial blogs

The following blogs are arranged from newest to the oldest based on the date that their domain is registered. They are either a one-woman/man team or a team that is organized around a personality. As you read, bear in mind the following benefits and disadvantages.

Pros

- You can read stories of struggles and successes of real people, so they resonate with your experience and aspirations.

- They are also consumers of financial products so they are equipped with end-user insights.

- Most of them really just want to share their experience and maybe earn from display ads. Others offer alternative ways of learning such as books, subscriptions, etc.

- Some of them are experts and you can benefit from their knowledge that is being shared freely on the internet.

Cons

- Information may not always be accurate.

- Subjective bias, even business interest, may come into play.

- Inconsistent posting schedule.

- Promotions of products and services.

So without further ado.

1. signed Marco

- Website: https://www.signedmarco.com/

- Date: March 9, 2020

- Owner: Marc Kenneth Marquez

Certified senior high school teacher Marc Kenneth Marquez owns the website signed Marco, previously known as iMillenial

. He shares being a first-time online seller on Lazada, is excited about the success of a friend’s start-up food venture, and talks about how we can all achieve financial success.

2. The Financial Adviser

- Website: https://financialadviser.ph/

- Date: December 16, 2019

- Owner: Henry Ong

The Financial Adviser is the blog of long-time Philippine Daily Inquirer business columnist and president of Young Entrepreneur Society, Henry Ong. By having said that, the website is rather scant of content.

However, that is hardly surprising given that it is fairly new. Still, it promises to continue talking about business lessons and tips, market analysis, and money lessons.

3. Peso Hacks

- Website: https://pesohacks.com/blog/

- Date: May 5, 2019

- Owner: Jerico Saquing

Peso Hacks is owned by Jerico Saquing. It is a blog that talks about not only how to save and make money, but also about how to find success online through freelancing gigs.

4. Katie Scarlett Needs Money

- Website: https://katiescarlettneedsmoney.com/

- Date: July 11, 2018

- Owner: Katie Scarlett (pseudonym)

Katie Scarlett Needs Money is a unique voice in the financial literacy space in the country. She does more than the usual, dry trivia on financial products, which is something blogs are expected to do. Instead, she compares similar products and uncovers their hidden costs, risks, and downsides.

Thus, her comparisons are well-researched and her conclusions decidedly sharp and honest. In fact, she doesn’t mince words calling out the lack of transparency on costs other than the management fee that’s disclosed on easily available brochures to the public.

More than that, she advocates for—and becomes in effect the mouthpiece of—smart consumers wary of advices that may be motivated by self-interest, i.e. to sell life insurance for example.

5. Pinay Investor

- Website: https://thepinayinvestor.com/

- Owner: Sheila

A BPO Trainer, college instructor, and self-confessed raketera Janice is a mom who can teach you how to budget, save, and invest!

She speaks from a place where she has grown wiser to young generations of Pinoys, telling them about her mistakes and warning to never repeat them.

6. The Thrifty Pinay

- Website: https://www.thethriftypinay.com/

- Date: May 5, 2018

- Owner: Ameena Rey-Franc

Ameena Rey-Franc is the woman behind the “personal finance, business, and lifestyle blog” The Thrifty Pinay.

Aside from being busy with her website, she writes, works freelance, aspires to be a digital entrepreneur, and in her own words is a mother and a homemaker “without a nanny.” If that sounds like a lot, that’s because it is.

As a matter of fact, she is the Super Mom on the internet, giving out tips on how to be frugal and reminding gently her readers to make sure that every peso is spent prudently.

7. Your Life in Perspective

- Website: https://www.yourlifeinperspective.com/

- Date: November 2, 2017

- Owner: Alfred

BPO employee and computer science graduate Alfred writes for Your Life in Perspective, a journal of his plan to a financially-free future. He offers guides on government contributions and pension, as well as tools to quickly compute stock cost-benefits and compound interest.

In the end, he blogs because he wants to give back in the hope that it would inspire others to start their own journey to financial freedom.

8. Kuripot Pinoy

- Website: http://www.kuripotpinoy.com/

- Date: January 15, 2017

- Owner: Ralph Gregore Masalihit

Ralph Gregore Masalihit, an IT professional and a graduate of Registered Financial Planner Institute-Philippines, created Kuripot Pinoy with the belief that there is “No shortcut. Work for it.”

Specifically, his writings are about changing mindset and starting anew each day. And of course, he throws in a tutorial on how to come up with your own statement of asset, liabilities, and net worth, as well as various tutorials on making and growing your wealth.

9. Digital EntrePinoy

- Website: https://butchlirios.com/

- Date: January 1, 2017

- Owner: Butch Lirios

Butch Lirios shares what he has learned so far about the struggles and challenges in opening up different income streams in Digital EntrePinoy.

Thus, his blog is chockful of helpful guides on ways to make money online such as how you can put up your own website, monetize your social media account, and launch your digital businesses.

And the clincher is that he did try what he had written—and he hopes that you do too—while still being gainfully employed in a 9-to-5 job. Ultimately, his goal is to be able to earn enough recurring income that could replace what he’s getting from his full-time job and become “financially free.”

10. SavingsPinay

- Website: https://www.savingspinay.ph/

- Date: December 6, 2016

- Owner: Izza Glino

Business woman Izza Glino is the writer and owner of SavingsPinay. Truly, her first post that she wrote when she was 20 years described her various income streams such as her day job and side hustles as wedding host and online shop owner.

Likewise, her website shows what it’s like to start and earn from blogging, how to grow your capital, and how to best manage your money. And there’s more, you can grab her free resources to get your hands on financial workbook, spreadsheet for budgeting, calendars, etc. Moreover, she has a another blog that covers lifestyle and another one dedicated to her wedding and events business.

And that, quite frankly, is exactly how you walk the talk.

11. The Pinay Investor

- Website: http://thepinayinvestor.com/

- Date: May 20, 2016

- Owner: Janice

Former BPO trainer turned blogger Janice writes for her own website The Pinay Investor. At the heart of her advocacy is financial literacy and family.

So you get very informative posts on parenting such as teaching kids about investing, saving a few bucks on groceries, and earning cashbacks from paying bills. In her words, her work is about sharing “practical and Bible-based tips.”

12. Vince Rapisura

- Website: http://vincerapisura.com/blog/

- Date: February 25, 2016

- Owner: Vince Rapisura

Former Ateneo de Manila University professor and social entrepreneur Vince Rapisura writes in English and Filipino in his blog that bears his name. Presently, the blog is easy to read and contains great guides on how to save and grow one’s money. Contents have anecdotes and advices that resonate with average Pinoys. More than that, he has a video series with celebrity guests that talks about how to manage one’s finances. As a matter of fact, the series has been running for several seasons.

13. Your Wealthy Mind

- Website: https://yourwealthymind.com/

- Date: July 30, 2015

- Owner: Ray L

Ray L. wants to help end poverty, and his website Your Wealthy Mind is a way to accomplish that goal. Actually, he trusts that when people are taught knowledge and skills, they can improve their lives. In effect, such faith is palpable in his writings. His posts are bilingual (Filipino and English) to better reach the audience. Aside from warning people to avoid scams, he talks about how to have a better mindset towards money and life.

14. Piso and Beyond

- Website: http://www.pisoandbeyond.com/

- Date: February 20, 2014

- Owner: Jeff Reyes

Teacher and programmer Jeff Reyes writes on Piso and Beyond. It is a blog that not only teaches ways to create wealth but also talks about changing deep-rooted mentality. Posts such as “The Book of Salamat” and “Is Your Excuse Bigger than Your Dreams” are thought-provoking and insightful.

15. Invest Money PH

- Website: https://investmentjuan01.com/blog/

- Date: September 9, 2013

- Owner: Gerald Flores

Gerald “Geri” Flores is the owner of Invest Money PH. It is a blog that not only has articles exhorting everyone to live their best life by being able to wisely take control of their money, it also has an online shop where his readers can purchase products and various stuff. Beginners can get started with the comprehensive newbie guide, and there are topics that cover investments, smart money habits, business tips, stock market, and how to manage debts.

16. FQ Mom

- Website: https://fqmom.com/articles/

- Date: June 26, 2013

- Owner: Rose Fres Fausto

Former investment banker, Philstar.com columnist, author and proud homemaker Rose Fres Fausto continues her life’s dream of financial inclusion for all Pinoys in her blog, FQ Mom. (FQ stands for financial intelligence quotient.) Aside from her posts, she also offers books, videos, podcasts, and tools.

17. FilipiKnow

- Website: https://filipiknow.net/category/how-tos-2/business-and-finance/

- Date: April 12, 2013

- Owner: Luisito E. Batongbakal Jr.

FilipiKnow may have become a catch-all of things uniquely Filipino, good or bad. But Luisito E. Batongbakal Jr. sure did reserve space discussing ways to improve your life by being more efficient with spending and wiser in increasing net worth. You’d read how-to’s on taxes, opening accounts, and yes, even increasing your odds in winning the lottery.

18. Rock to Riches

- Website: https://burngutierrez.com/

- Date: October 14, 2012

- Owner: Burn Gutierrez

Musician and songwriter Burn Gutierrez writes in Rock to Riches. He opens up about the decision of staying in the country for good and to work hard to be successful after working abroad for two years. The blog contains helpful guides on many sundry matters such as surviving through the pandemic, investing in the stock market, etc.

19. Investing In Philippines

- Website: http://investinginphilippines.com/

- Date: September 22, 2012

- Owner: Louise Delos Angeles, CPA

Certified public accountant Louis Delos Angeles runs the Investing In Philippines website. Expectedly, it started out focusing on stock investing. It has since moved into other areas of personal finance such as emergency funds, saving, and how to be freed from debts.

20. Frugal Honey

- Website: https://www.frugalhoney.com/

- Date: September 18, 2012

- Owner: Jill Sabs

Owned by Jill Sabs who, according to one of the posts, is part of the country’s judiciary, Frugal Honey chronicles the financial aspects of her (as she herself describes) “cushy middle class” life as a working wife and mother.

Aside from the run-of-the-mill contents (Pag-ibig loans, tips in applying online jobs, etc.), the most interesting posts are when she describes her life experiences.

For example, her August 2020 cash flow where she writes about the challenge of paying mortgage, credit card, and insurance premiums, not an easy feat for the faint of heart.

Or a post about a point in her life when she was thinking to migrate to another country, which didn’t push through, that ends with a hopeful tune that should her children wish to do the same in the future, she’d give her 100% support.

Her writing voice is articulate, self-aware, and in more ways personal. And that makes her blog down to earth, familiar and relatable.

21. Ambitious Pawn

- Website: https://ambitiouspawn.com/

- Date: April 20, 2012

- Owner: (not available)

No one knows who writes for Ambitious Pawn, but they sure don’t find it hard crunching numbers and have a clear style. (Of course, a bit of sleuthing would lead you to their Reddit account, and they did mention they’ve once worked in the U.S.) Truly, that’s what makes their blog a cut above from the clutter: an understanding on investing with local and foreign knowledge, critical thinking, and a way of communicating that is nearly precise. And in an age of self-anointed influencers hogging every chance of promotion, their anonymity while giving out valuable contents is actually very rare.

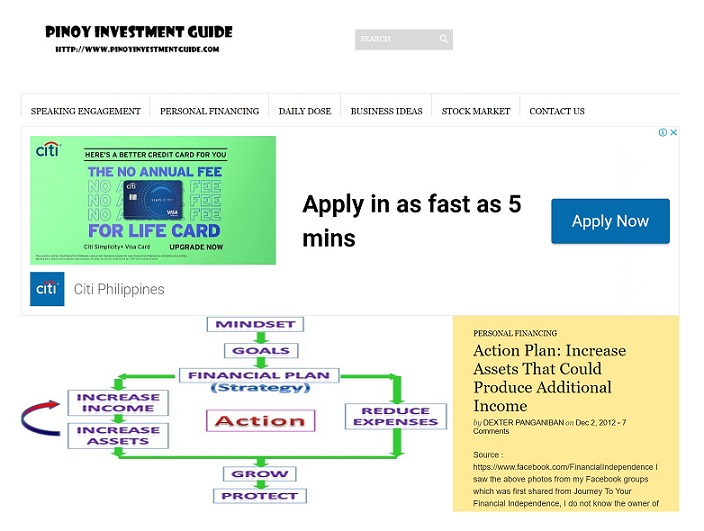

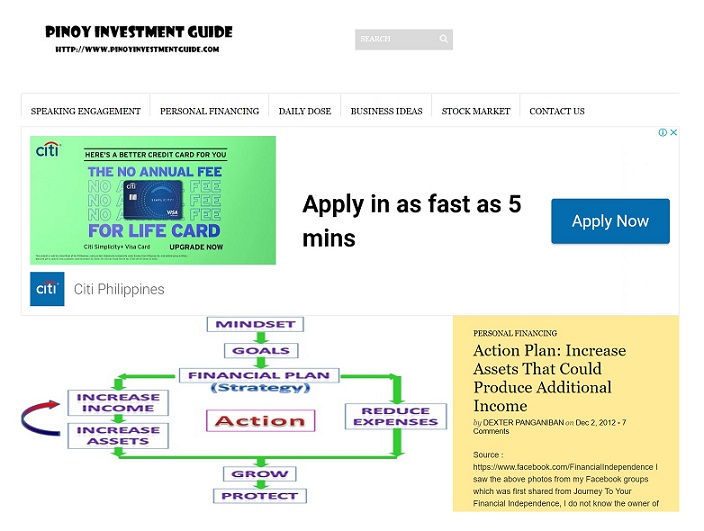

22. Pinoy Investment Guide

- Website: https://www.pinoyinvestmentguide.com/

- Date: November 28, 2011

- Owner: Dexter Panganiban

Dennis Panganiban excitedly informed through his blog, Pinoy Investment Guide, that his then 10-year old son had started investing in a retail giant in 2012. Stories about his family learning about the basics of investing, such as watching a Warren Buffet interview together, are sprinkled among useful tips on real estate, bitcoin, etc. Of course, the blog talks about business ideas, stock market, daily dose of life hacks, and investing.

23. Pesos And Sense

- Website: http://pesosandsense.com/

- Date: August 19, 2011

- Owner: Aya Laraya

Aya Laraya, a licensed stock broker, owns Pesos and Sense, which is also the name of the TV show he hosted in 2011. Definitely, its goal “… is to empower Filipinos by teaching simple and practical knowledge in making independent and wise choices in handling their money.” Aside from written contents, Laraya offers both in-person and online seminars and free videos, including the full season of the show, on the website.

24. Randell Tiongson

- Website: https://www.randelltiongson.com/blog/

- Date: June 8, 2009

- Owner: Randell Tiongson

Host, author, and registered financial planner Randell Tiongson maintains a website (named after him) that has a blog, courses, seminars, and online shopping gateway for his books and other resources.

Indeed, going through his posts might seem discouraging for casual reader because of the number of at times not so subtle invites to his for-pay classes. However, there are very many helpful info on how to become the best version of oneself in terms of managing money. Surely, his articles are written in religious tone, tying both personal wealth and spirituality as essential to living a good, contented, godly life.

25. Millionaire Acts

- Website: https://www.millionaireacts.com/

- Date: November 24, 2008

- Owner: Tyrone Charles Solee

Tyrone Charles Solee, through Millionaire Acts, gives away his secret on how he was able to become a millionaire by the young age of 26 years old. Indeed, he achieved that roughly over four years after he got his first job. A math major graduate, investment analyst, and market researcher, Solee writes the steps on how to get your first million and many income opportunities to augment your savings.

26. Ready to be Rich

- Website: https://fitzvillafuerte.com/

- Date: February 2, 2008

- Owner: Fitz Villafuerte

Online personality Fitz Villafuerte owns Ready to be Rich, a blog that’s started way back in 2008. In fact, he has since launched an online presence in various platforms and media, such as podcast and videos. Nevertheless his blog is clearly his personal journal, its About page openly shares his journey and dreams. It has since evolved into a resource that covers topics ranging from mind setting to income opportunities, like an older brother trying to teach you skills to be able to make the most out of life.

27. Chinkee Tan

- Website: https://chinkeetan.com/blog

- Date: December 6, 2007

- Owner: Chinkee Tan

Host, author, and erstwhile actor Chinkee Tan is one of the most visible advocates of personal finance in the country. His radio and TV shows, books, social media channels and website are a success, for example.

Particularly, his eponymous blog is motivational and God-centric. It has vignettes, quips, tips, and tricks written in Filipino and in a language that is simple, easy to understand and accessible to every Pinoy wanting to learn how to be “wealthy and debt-free.”

28. Pinoy Money Talk

- Website: https://www.pinoymoneytalk.com/

- Date: March 1, 2005

- Owner: James Ryan Jonas

James Ryan Jonas owns Pinoy Money Talk. In this list, its domain is the oldest registered. And this fact shows.

The website is bursting in the seams with content. Similarly, a quick glance reveals that it talks about how to make money, stock trading, mutual fund, franchises, UITF, real estate, and how to retire rich and financially free.

29. Juan Investor

- Website: http://www.juaninvestor.com/

- Owner: Paul Dabuco

A blog on business, investments, and personal finance is called Ready To Be Rich. Filipino investor, entrepreneur, and registered financial planner Fitz Villafuerte. He started this blog in the hopes that his experiences will motivate others to go on their own paths to financial freedom.

30. Randell Tiongson

- Website: randelltiongson.com

- Owner: Randell Tiongson, RFP

Marco is an online publisher and resource for personal finance and related topics, including advice, analysis, and reviews, with a base in the Philippines. The site encourages financial awareness among young Filipino millennials in the Philippines and around the world under the banner of the stylishly and witty coined trademark iMillennial, which stands for investing millennial.

9 Personal finance and financial websites run by companies

Next is the list of websites run by companies that discuss how to manage your money. The difference between this list from the one above is that there is a whole team behind the sites. Secondly, they’re not organized around a person or celebrity.

Furthermore, several websites may serve as a means to an end of being sales channels to convert users from prospects to customers of their various products and services.

Pros

- They can afford to pay staff, so contents can be produced consistently.

- Contents may have passed through editorial review.

- Staff and writers may have years of experience in the financial industry.

Cons

- Blogging can be a way to drive traffic to their website to acquire new prospects and convert them into sales.

- Corporate interest and bias may come into play.

1. Grit.PH

- Website: https://grit.ph/blog

- Start date: October 26, 2017

- Publisher: Jason Acidre

Grit.PH is what a financial blog becomes when it is highly optimized for search engines. In other words, it is slick, smooth, easy to use, and readable. Firstly, it contains quick guides on Personal Finance.

Secondly, its Business section lays out tips and advices for budding business owners.

Next, it helps out new graduates how to land their dream job under Career. Lastly, the contents under Life Hacks are all about making life easier, such as having smooth experience in the dreaded task of getting a driver’s license.

2. Moneygment

- Website: https://moneygment.ph/blog/

- Start date: September 28, 2017

- Publisher: Togetech

Moneygment is the mobile app developed by Togetech Inc. As a fintech company, it caters to people who currently are not serviced by banking institution, advocating for inclusivity for Pinoys.

Its blog is a portal to topics that are consistent with financial literacy, money saving habits and tips, and easy payment of government contributions such as Philhealth, SSS, and Pag-ibig.

3. eCompareMo

- Website: https://www.ecomparemo.com/info

- Date: June 9, 2014

- Owner: SnapCompare Corporation, C88 Financial Technologies (Indonesia)

eCompare Mo is primarily a digital sales channels. Moreover, it is a subsidiary of the Southeast Asian start-up that’s received funding from private equity ventures globally. Their blog is about “… financial news, motoring features, money tips, and other insightful reads to help you get smarter every day.”

4. Coins.ph

- Website: https://coins.ph/blog/

- Date: December 14, 2013

- Owner: (not stated)

The blog contents of Coins.ph, an online banking and digital payment service company, can be a useful resource on anything from getting cashback to money matters.

5. Pawn Hero PH

- Website: https://blog.pawnhero.ph/

- Date: November 15, 2013

- Owner: (not stated)

Pawn Hero PH has a blog roll of contents ranging from items that people can pawn during the pandemic to hacks in being able to save in the midst of Christmas holidays.

6. MoneySmart

- Website: https://www.moneysmart.ph/

- Date: October 16, 2013

- Owner: Catapult Ventures Pte Ltd (Singapore)

MoneySmart is simply a website that consistently publishes write-ups about helping people make better money decisions. Contents are organized in four main categories: earn money, smart money, borrow money, and lifestyle.

7. Moneymax

- Website: https://www.moneymax.ph/articles

- Date: June 26, 2013

- Owner: Moneyguru Philippines Corporation, CompareAsia Group Limited (Hong Kong, Singapore)

Moneymax compares similar products and provides a way for prospects to purchase them easily through the website. Its blog’s tagline is “The latest and the best financial news, tips and tricks.”

8. iMoney.PH

- Website: https://www.imoney.ph/articles/

- Date: November 29, 2012

- Owner: Intelligent Money Sdn Bhd (Malaysia)

iMoney.PH is a medium through which companies can reach out to their target market. Surely, their blog covers areas about banks, loans, lifestyle, debts, and online security.

9. Money Sense

- Website: https://www.moneysense.com.ph/

- Date: August 8, 2006

- Owner: MoneyTree Publishing Corp.

Money Sense is the online version of the magazine that has been pushing for inclusion of Filipinos to the financial industry.

Specifically, its wide ranging topics cover many different aspects including business news, inspirational stories, insurance, real estate, taxes, and retirement. In addition, it has an online shop where you can purchase current and past issues of the magazine.

5 Personal finance and financial website & blogs run by advisors

Lastly, these are blogs managed by advisors in the financial industry.

Pros

- They are passionate about their work.

- Because they’ve met people from different walks of life, they’re able to distill both their personal and others’ experiences into their blog.

- Insurance and mutual fund advisors may have gone through required training and are licensed by the Insurance Commission and Securities and Exchange Commission, respectively.

- They’re always hiring for new advisors.

Cons

- Business interest may come into play.

- Contents, as well recommendations, can be limited to the products and services of companies that they’re accredited with.

- Agents in brokerage companies may not have undergone licensure exams with any regulatory bodies.

1. My Wise Finances

- Website: https://mywisefinances.com/blog/

- Date: March 21, 2018

- Owner: Faye Rocero

Faye Rocero, daughter of an OFW, owns My Wise Finances. Through the blog, she reaches out to her readers in the hopes that they can learn how to be able to achieve financial freedom.

2. The Wise Guy PH

- Website: http://www.thewiseguyph.com/

- Date: October 5, 2017

- Owner: Federico Suan, Jr.

Federico Suan, Jr. chronicles his journey and writes tutorials on savings and similar topics in The Wise Guy PH.

3. My Money Wise Tips

- Website: http://mymoneywisetips.com/

- Date: May 15, 2017

- Owner: Christine Caranyagan

Christine Caranyagan writes for My Money Wise Tips where she talks about insurance, mutual funds and being all in all better managers of one’s income.

4. Financial Literacy Advocacy

- Website: http://financialliteracyadvocacy.com/financial-literacy-advocacy-group/

- Date: October 12, 2016

- Owner: Divine

Divine is the founder and mentor of the Financial Literacy Advocacy Group. According to her, “We do not have to do anything grand in this life to make it fulfilling. We just have to do little deeds with a big heart and inspire others to do the same.”

5. Money Talk PH

- Website: https://www.moneytalkph.com/blog/

- Date: November 2, 2012

- Owner: Raymund Fabro Camat

Raymund Fabro Camat is owner of the blog Money Talk PH, where he writes about his story, shares tips about achieving success, and encourages everyone to be always prepared for any untoward events one may face in life.

Key Takeaways:

Learning from the pros and following people who are on the path to financial freedom is one of the finest methods to manage your money more effectively.

There are many of excellent financial blogs, and you can learn a lot from leading financial bloggers in the Philippines who freely share their expertise, information, and advice.

Read More:

Credit Card Fees and How You Can Avoid Them Philippines

What are the Best Credit Cards With Zero Annual Fee in the Philippines this 2022?

What are the Best Savings Accounts in the Philippines 2022